For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.1396.

In economic news, Germany’s seasonally adjusted industrial production fell less-than-expected by 0.5% MoM in February, compared to market expectations for a drop of 1.8%. In the prior month, industrial production had registered a revised rise of 2.3%. On the other hand, the nation’s construction PMI dropped to a level of 55.8 in March, from a reading of 59.6 in the previous month.

The greenback lost ground, after the latest FOMC policy meeting minutes underscored caution about future interest rate hikes. Minutes also indicated that policymakers debated whether an interest rate hike would be needed in April. However, a majority of them stated that global headwinds would probably persist and thereby argued that they should be careful about raising rates.

Separately, the Cleveland Fed President, Loretta Mester, reiterated that she expects gradual interest rate hikes this year and that the Fed is not actually “behind the curve” in rate hikes. Further, she expects the nation’s economic growth to pick up to a 2.25%-2.5% range this year, that is slightly lower as compared to her earlier forecast, which she mainly attributed to weakness in the fourth quarter growth and tighter financial conditions.

In other speech, the St. Louis Fed President, James Bullard, mentioned that a growth slowdown in the first quarter is probably related to seasonal factors and has not fundamentally changed the US economic outlook, given that inflation has picked up slightly. He also stated that the nation is in need of a long-term economic plan including tax and education reforms to revive growth and should not solely rely on more monetary or fiscal stimulus for a short-term boost.

In other economic news, US mortgage applications rose for the first time in four weeks by 2.7% in the week ended 01 April 2016. Mortgage applications had dropped 1.0% in the prior week.

In the Asian session, at GMT0300, the pair is trading at 1.1402, with the EUR trading 0.06% higher from yesterday’s close.

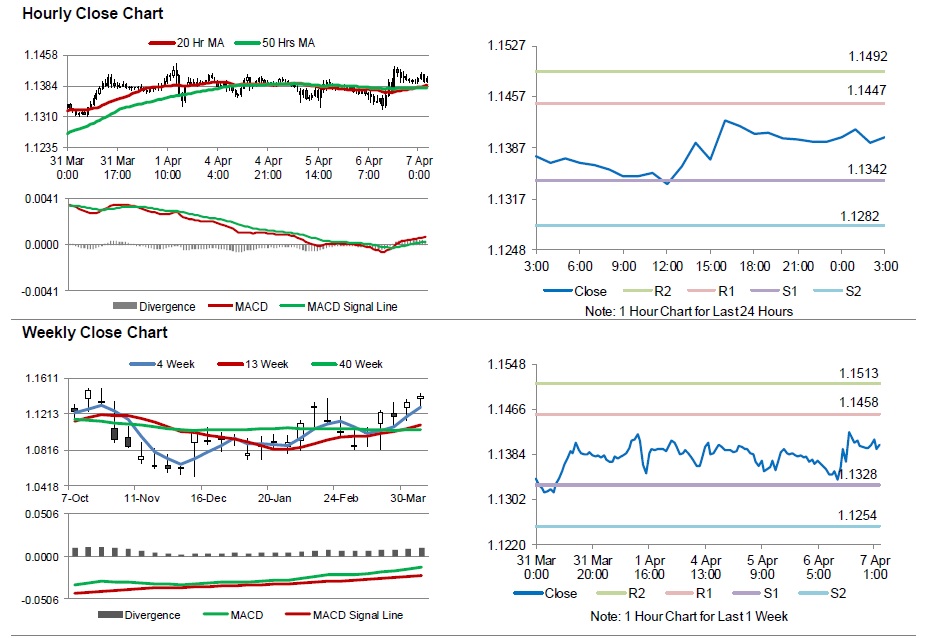

The pair is expected to find support at 1.1342, and a fall through could take it to the next support level of 1.1282. The pair is expected to find its first resistance at 1.1447, and a rise through could take it to the next resistance level of 1.1492.

Going ahead, market participants will look forward to the ECB’s account of monetary policy meeting, scheduled in a few hours. Additionally, US Initial jobless claims data and the Fed chairperson, Janet Yellen’s speech, due later today, will also garner investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.