For the 24 hours to 23:00 GMT, the EUR declined 1.55% against the USD and closed at 1.1170, as investors shrugged off the upbeat manufacturing & services PMI data across the Euro-zone and instead focused on hawkish statement by Federal Governor, Jerome Powell. The Governor suggested that two rate hikes were possible this year, one in September and the other in December. He expected stronger economic growth in the second half of 2015 following improvement in the labour market and added that inflation would start to rise as the impact of low energy prices and a high dollar start to fade.

Meanwhile, data released showed that Germany’s preliminary estimate of manufacturing PMI advanced more than expected to a level of 51.9 in June, compared to a reading of 51.1 in May, while the services PMI figure surprisingly edged up to 54.2 in June, following a level of 53 registered in may. The stronger than expected figures suggested that Germany, the Euro-zone’s biggest economy ended the quarter on a stronger footing. Additionally, the Euro-zone’s preliminary print of services and manufacturing PMI data came in better than market forecasts in June, indicating that the European economy was recovering on the back of ECB’s quantitative easing measures and low interest rates.

Elsewhere, in France, the manufacturing activity swung back to expansion territory, after the manufacturing PMI rose to 50.5 in June, compared to previous month’s level of 49.4.

In the US, durable goods orders fell more than anticipated by 1.8% in May, dragged down by a sharp decline in aircraft orders. The decrease was the third in the last four months, after it had fallen by a revised 1.5% in the preceding month. Meanwhile, the nation’s manufacturing PMI unexpectedly slumped to a reading of 53.4, its lowest level since October 2013 in June

On the other hand, new home sales topped estimates, after rising more than expected by 2.2% MoM in May, compared to a revised increase of 8.1% in the preceding month.

In the Asian session, at GMT0300, the pair is trading at 1.1186, with the EUR trading 0.14% higher from yesterday’s close.

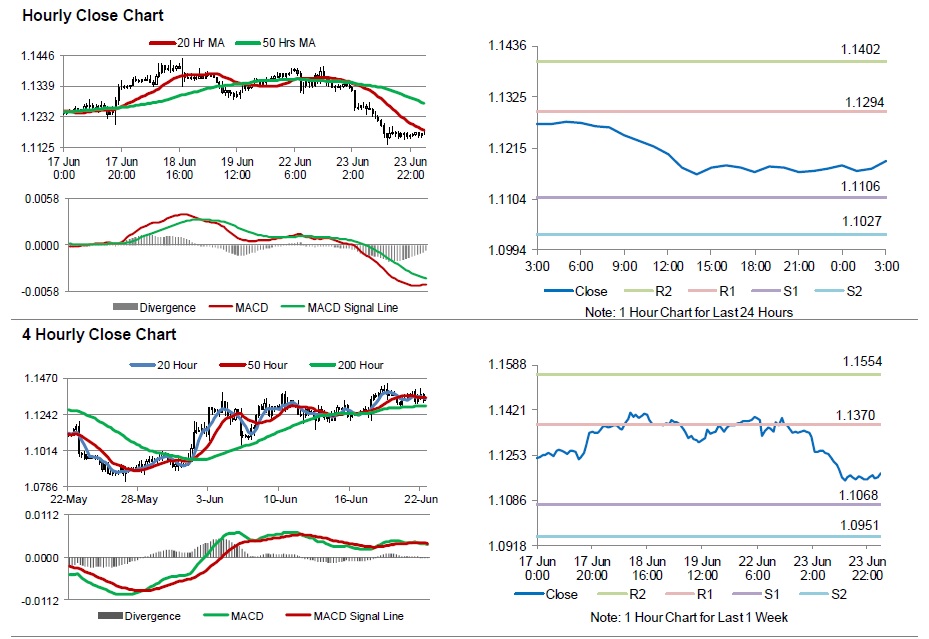

The pair is expected to find support at 1.1106, and a fall through could take it to the next support level of 1.1027. The pair is expected to find its first resistance at 1.1294, and a rise through could take it to the next resistance level of 1.1402.

Trading trends in the Euro today are expected to be determined by the outcome of the European Union’s emergency meeting, scheduled later today. Additionally, the US annualized Q1 GDP data, scheduled later today would capture lot of eye-balls.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.