On Friday, the EUR declined 0.27% against the USD and closed at 1.1342.

In economic news, industrial production in the Euro-zone rebounded 0.1% MoM in April, following a revised drop of 0.4% in the previous month.

In the US, the San Francisco Fed President, John Williams opined that he will prefer to be in wait-and-see mode regarding an interest rate hike, until the US inflation inches towards the Fed’s 2% inflation target. However, he added that if the Fed raises rates sooner rather than later, it will be done gradually.

In the Asian session, at GMT0300, the pair is trading at 1.1381, with the EUR trading 0.34% higher from yesterday’s close.

The Greek crisis will remain the centre of attraction, as the European Union (EU) leaders will meet today for an emergency meeting in order to break the current deadlock after all previous attempts failed.

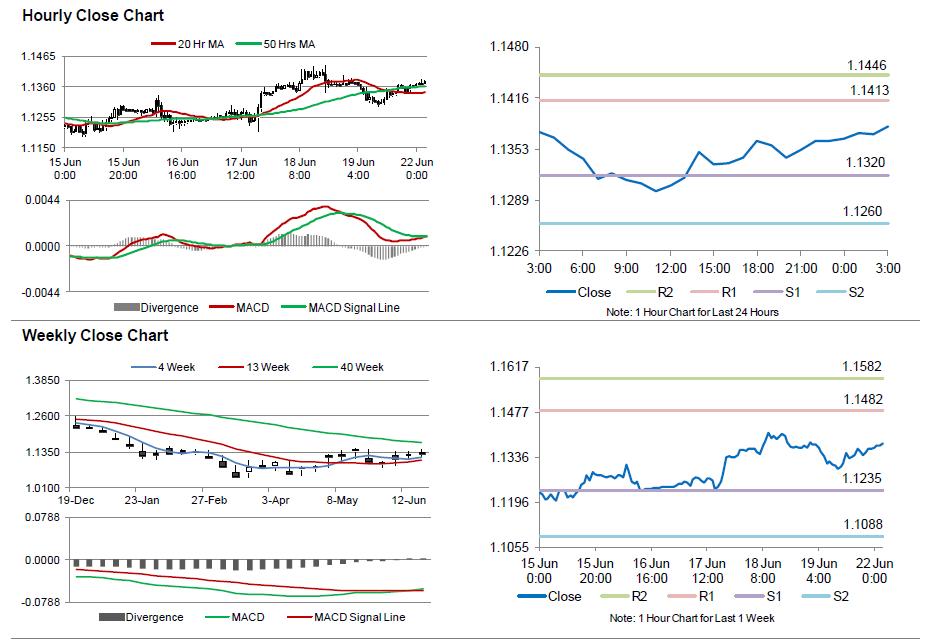

The pair is expected to find support at 1.1320, and a fall through could take it to the next support level of 1.1260. The pair is expected to find its first resistance at 1.1413, and a rise through could take it to the next resistance level of 1.1446.

Trading trends in the Euro today are expected to be determined by the outcome of an emergency meeting of the Euro-zone, scheduled later today to cease the Greek crisis.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.