For the 24 hours to 23:00 GMT, the EUR declined 0.28% against the USD and closed at 1.1246, following Germany’s dismal ZEW survey data.

Data released showed that Germany’s ZEW economic sentiment index slipped to a 7-month low of 31.5 in June, lower than market expected drop to 37.3 and compared to prior month’s reading of 41.9, while the current situation index deteriorated to a level of 62.9 in June, from 65.7 in May, indicating that the economic revival in the Euro-zone’s largest economy is losing its momentum.

Other economic data showed that the final estimate of Germany’s consumer prices rose 0.1% MoM in May, in line with market expectations.

In the US, buildings permits unexpectedly rose 11.8%, notching a near eight-year on a monthly basis in May, following a revised advance of 9.8% in the previous month. On the other hand, the nation’s housing starts fell more than expected by 11.1% MoM in May, compared to a revised rise of 22.1% in April.

In the Asian session, at GMT0300, the pair is trading at 1.1255, with the EUR trading 0.08% higher from yesterday’s close.

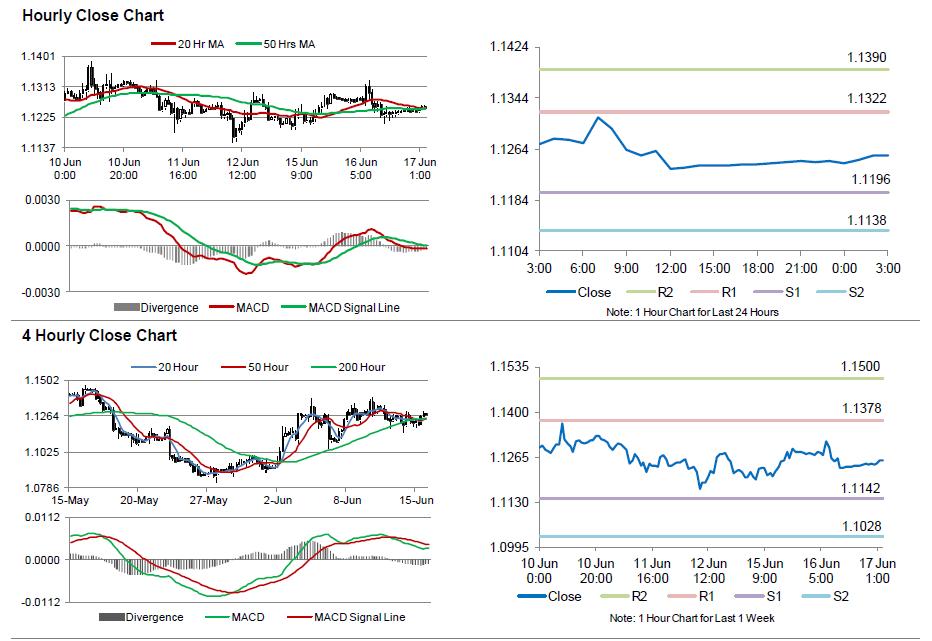

The pair is expected to find support at 1.1196, and a fall through could take it to the next support level of 1.1138. The pair is expected to find its first resistance at 1.1322, and a rise through could take it to the next resistance level of 1.1390.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s inflation data, scheduled in a few hours. Additionally, the Fed’s interest rate decision would grab lot of market attention, scheduled later today.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.