For the 24 hours to 23:00 GMT, the EUR rose 0.32% against the USD and closed at 1.1139, after Germany’s flash consumer price index rebounded 0.3% MoM in May and matched market expectations, following a 0.4% decline in the previous month. Meanwhile, the Euro-zone’s economic sentiment indicator advanced more- than-expected to a four-month high level of 104.7 in May, after registering a reading of 104.0 in the previous month. Additionally, the region’s business climate indicator rose to a four-month high level of 0.26 in May, compared to market expectations of an advance to 0.17. In the prior month, the business climate indicator had recorded a revised level of 0.15. Moreover, the Euro-zone’s final consumer confidence index rose to a level of -7.0 in May, in line with market expectations. The consumer confidence index had recorded a level of -9.3 in the previous month, while the preliminary figures had also indicated a rise to -7.0.

In the US, the St. Louis Fed President, James Bullard, stated that global markets appeared to be “well-prepared” for a US Federal Reserve’s summer rate hike.

On Friday, the US Fed Chairwoman, Janet Yellen, indicated that a rate hike in the coming months “would be appropriate,” if the nation’s economy and labour market continues to improve.

On the data front, the second estimate of the US annualized gross domestic product rose 0.8% in 1Q 2016, compared to market expectations for a rise of 0.9%. The annualized GDP had climbed 1.4% in the previous quarter and the preliminary figures had indicated an advance of 0.5%.

In the Asian session, at GMT0300, the pair is trading at 1.1146, with the EUR trading 0.06% higher from yesterday’s close.

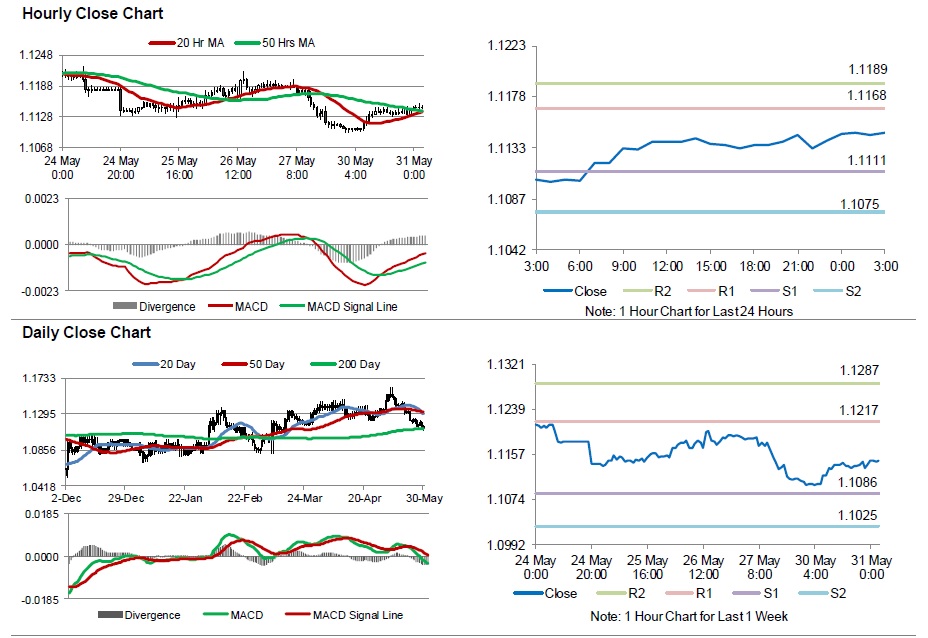

The pair is expected to find support at 1.1111, and a fall through could take it to the next support level of 1.1075. The pair is expected to find its first resistance at 1.1168, and a rise through could take it to the next resistance level of 1.1189.

Going ahead, investors look forward to Germany’s retail sales for April and the Euro-zone’s consumer price index data for May, scheduled to release in a few hours. Moreover, the US consumer confidence and Chicago purchasing managers’ index, both for the month of May, due later today, will also attract investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.