For the 24 hours to 23:00 GMT, the EUR declined 0.48% against the USD and closed at 1.0933.

The greenback traded on a stronger footing, as the US economy picked up steam in the second quarter, after the nation’s GDP expanded at an annual rate of 2.3% in the April-June period, compared to a revised growth of 0.6% growth in the previous quarter, suggesting that the Fed would come closer towards an interest rate hike in 2015.

In other economic news, initial jobless claims in the US increased to 267.00 K, in the week ended 25 July, compared to a reading of 255.00 K in the previous week. Markets were anticipating it to rise to 270.00 K.

Elsewhere, in Germany, the preliminary estimate of consumer prices rebounded 0.2% on a monthly basis in July, in line with market expectations and following a 0.1% drop recorded in the previous month. Meanwhile, the nation’s seasonally adjusted unemployment rate remained stable at 6.4% in July, matching consensus estimates.

In the Asian session, at GMT0300, the pair is trading at 1.0942, with the EUR trading 0.08% higher from yesterday’s close.

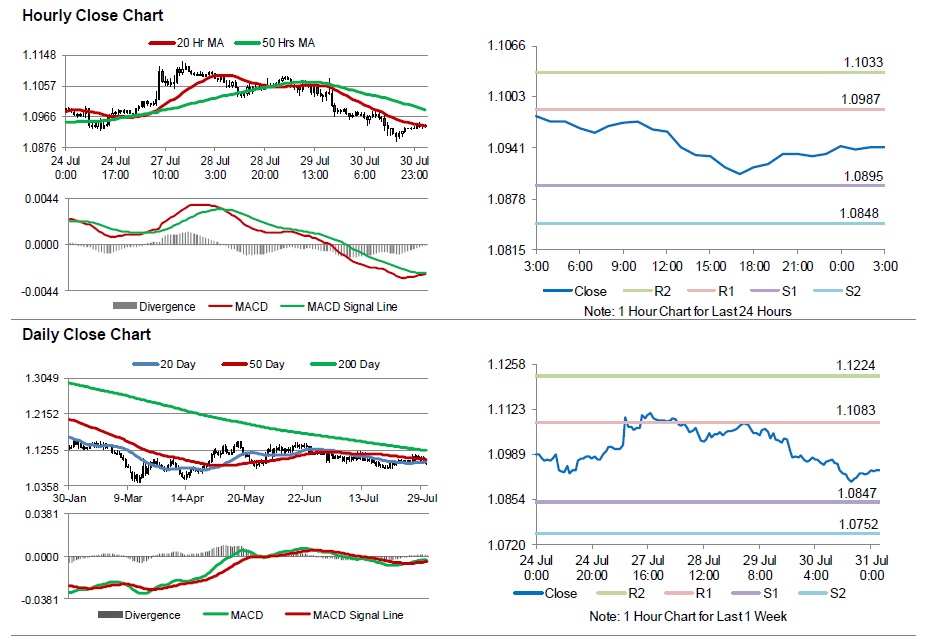

The pair is expected to find support at 1.0895, and a fall through could take it to the next support level of 1.0848. The pair is expected to find its first resistance at 1.0987, and a rise through could take it to the next resistance level of 1.1033.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s consumer price inflation along with the employment data, set for release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving averages.