For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.2690.

On the macro front, consumer prices in Germany came in flat, on a monthly basis, in September, similar to an unchanged reading registered in the previous month. Markets were expecting the index to drop 0.1% in September.

In other economic news, the Euro-zone’s economic sentiment indicator recorded a drop to 99.9 in September, compared to a level of 100.6 in the previous month. Additionally, the business climate indicator eased to 0.07, compared to a level of 0.16 in the previous month, thus raising concerns over the economic health of the single-currency region. In the Euro-zone, the final consumer confidence index remained flat at -11.4 in September, in line with the preliminary figures.

Elsewhere, in Spain, CPI dropped 0.2%, on an annual basis, in September, while retail sales unexpectedly rose 0.4%, on an annual basis, in August.

In the US, pending home sales dropped 1.0% on a monthly basis in August, more than market expectations for a drop of 0.5% and compared to a revised rise of 3.3% registered in the previous month. Meanwhile, personal spending in the US climbed 0.5% in August, compared to market expectations of 0.4% rise. Additionally, personal income in the nation rose 0.3% in August, in line with market expectations and following a 0.2% gain registered in the prior month. Similarly, the Dallas Fed manufacturing index climbed to 10.8 in September, up from 7.1 registered in August. Markets were expecting it to rise to 10.5.

Separately, the Chicago’s Fed President, Charles Evans, opined that he would prefer to hold interest rate near zero till the first-quarter of 2016, so that to ensure that the economy is able to withstand high borrowing costs. He, further, indicated that the Fed should delay interest-rate hikes until it is confident that the US economy is recovering.

In the Asian session, at GMT0300, the pair is trading at 1.2694, with the EUR trading marginally higher from yesterday’s close.

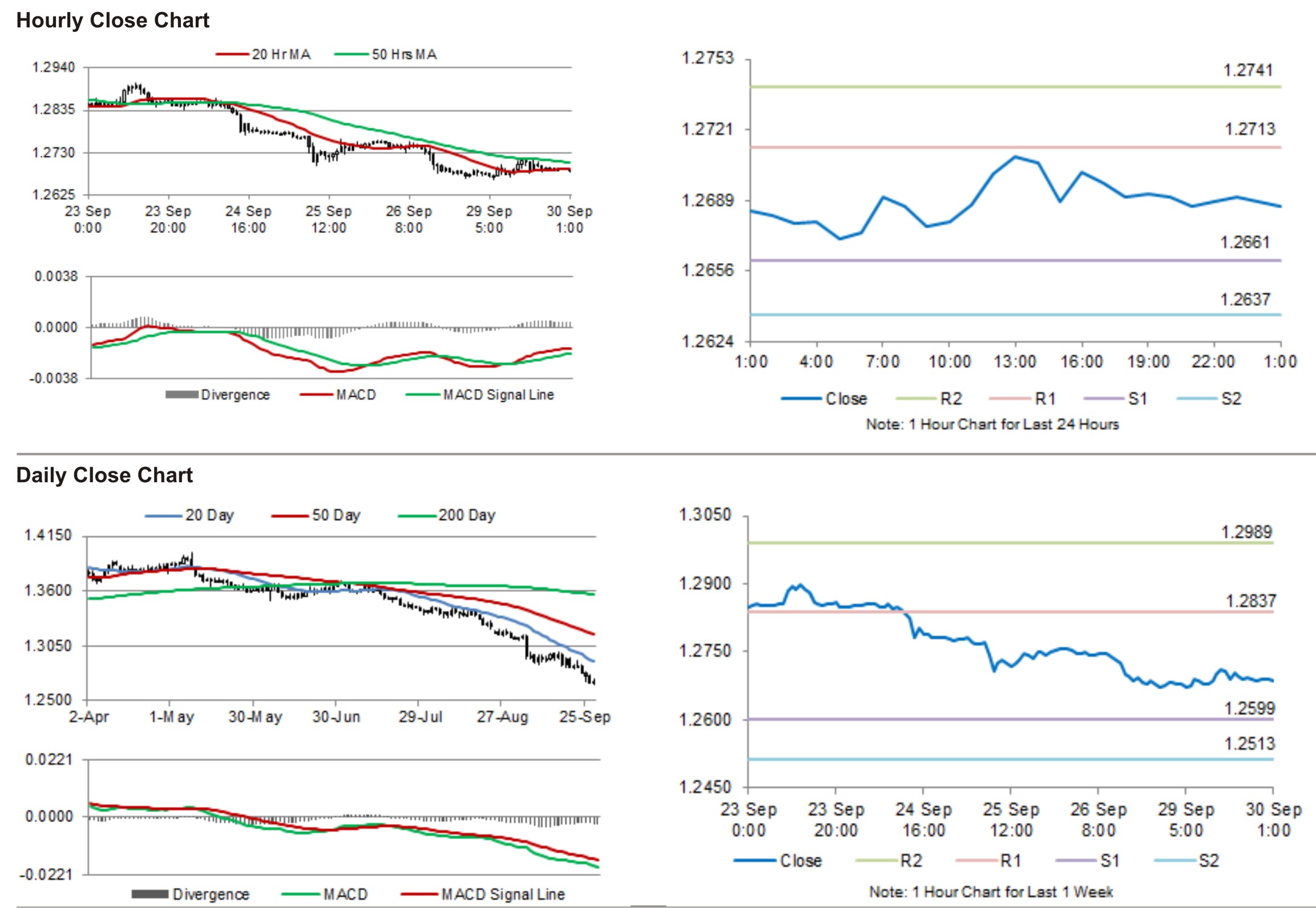

The pair is expected to find support at 1.2667, and a fall through could take it to the next support level of 1.2639. The pair is expected to find its first resistance at 1.2719, and a rise through could take it to the next resistance level of 1.2743.

Trading trends in the Euro today would be determined by the Euro-zone’s crucial CPI as well as unemployment data, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.