For the 24 hours to 23:00 GMT, the EUR declined 0.31% against the USD and closed at 1.1272, after the release of weak ZEW survey data in Germany.

Data showed that the German ZEW economic sentiment index slumped to a level of 12.1 in September, following a level of 25.0 recorded in August, affected by concerns about an economic slowdown in emerging markets. On the other hand, the nation’s current situation index rose to a reading of 67.5 in September, from 65.7 points in August and surpassed expectations for a fall to 64.0.

In other economic news, the Euro-zone’s ZEW economic sentiment index dropped to 33.3 points in September, compared to a level of 47.6 registered in August, while the region’s seasonally adjusted trade surplus swelled to €22.4 billion in July, after registering a surplus of €21.9 billion.

In the US, retails sales rose 0.2% in August, below an expected 0.3% gain, following a revised increase of 0.7% in the preceding month. However, the US advance retail sales data still points that the nation’s economy is strong enough to withstand the first interest rate hike in nearly a decade. Meanwhile, industrial production in the US contracted more than market forecast by 0.4% in August, after recording an upwardly revised rise of 0.9% in July, while manufacturing production slid 0.5% in August, following a robust rise in the previous month.

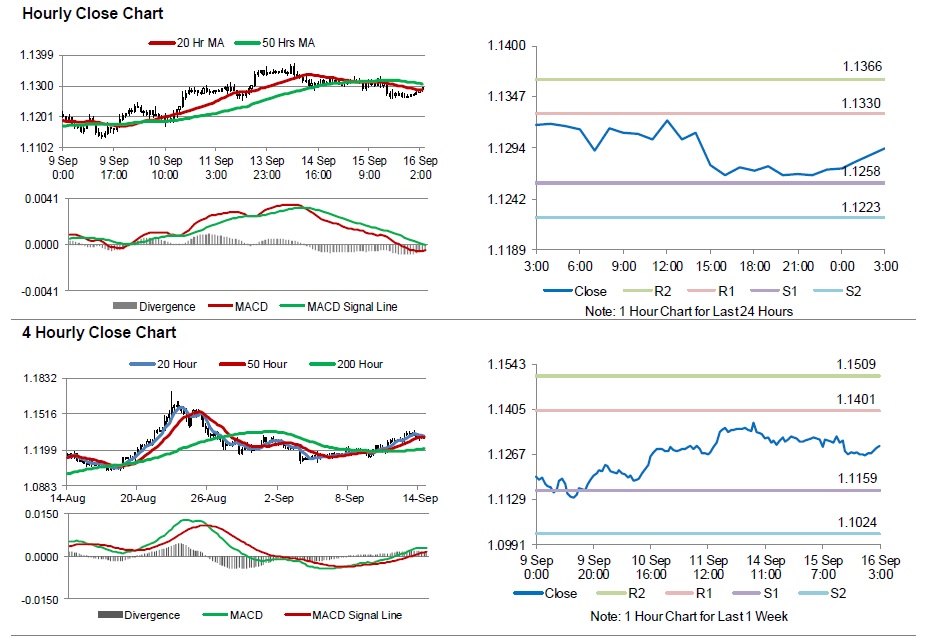

In the Asian session, at GMT0300, the pair is trading at 1.1294, with the EUR trading 0.2% higher from yesterday’s close.

The pair is expected to find support at 1.1258, and a fall through could take it to the next support level of 1.1223. The pair is expected to find its first resistance at 1.133, and a rise through could take it to the next resistance level of 1.1366.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s consumer price inflation data, scheduled in a few hours. Additionally, the US inflation data, scheduled later today would grab lot of market attention.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.