For the 24 hours to 23:00 GMT, the EUR declined 0.56% against the USD and closed at 1.0744.

In economic data, the Euro-zone’s seasonally adjusted industrial production dropped less-than-expected by 0.8% on a monthly basis in September, compared to a revised rise of 1.8% in the prior month whereas markets anticipated it to fall by 1.0%.

The US Dollar gained ground against most of its peers, amid speculation that shift in economic policies under the presidency of Donald Trump would spur inflation and economic growth in the world’s largest economy.

Meanwhile, the Federal Reserve Bank of Richmond President, Jeffrey Lacker, stated that a possible fiscal stimulus to shore-up the economy under the Presidency of Donald Trump would bolster case for raising rates. Separately, Dallas Federal Reserve Bank President Robert Kaplan stated that it is too early to react to potential policy changes by the incoming administration of president-elect Donald Trump and maintained his forecast that the US economy would grow about 2.0% next year.

In the Asian session, at GMT0400, the pair is trading at 1.0753, with the EUR trading 0.08% higher against the USD from yesterday’s close.

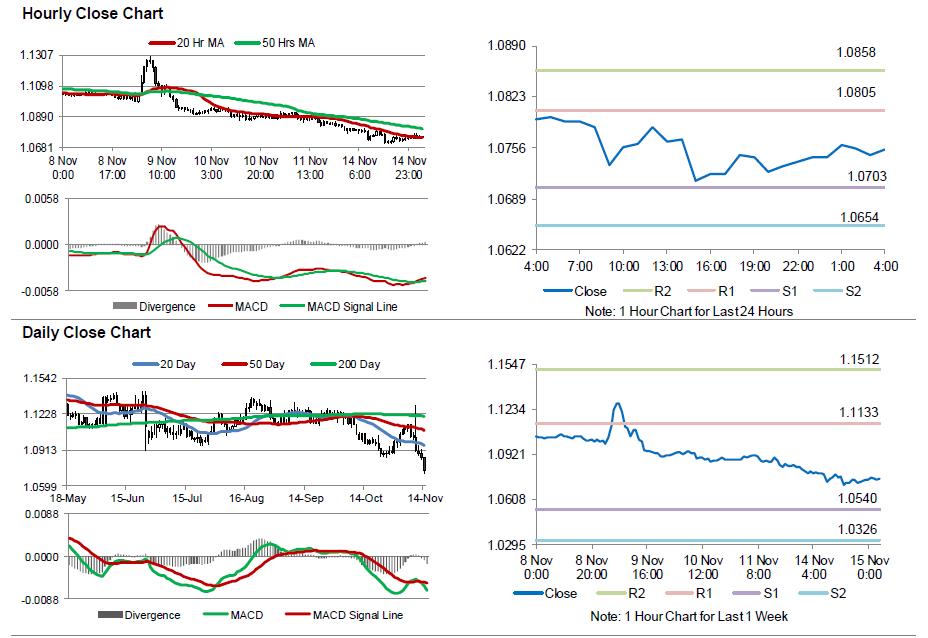

The pair is expected to find support at 1.0703, and a fall through could take it to the next support level of 1.0654. The pair is expected to find its first resistance at 1.0805, and a rise through could take it to the next resistance level of 1.0858.

Moving ahead, investors would look forward to the Euro-zone’s flash GDP figures for 3Q and trade balance for September, accompanied with ZEW survey data for November across the Euro-zone, all due to release in a few hours. Moreover, the US retail sales for October and business inventories for September, slated to release later today, would garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.