For the 24 hours to 23:00 GMT, the EUR rose 0.65% against the USD and closed at 1.1470.

On the macro front, Italy’s seasonally adjusted industrial production rebounded more-than-expected by 0.7% MoM in May, rising at its fastest pace in three months. Industrial production had fallen by a revised 0.5% in the prior month, while market participants had expected for a gain of 0.5%.

The greenback declined against its major peers, after the release of Donald Trump Jr.’s emails about a meeting with a Russian lawyer to obtain withering information on Hillary Clinton in last year’s election campaign.

In the US, data indicated that the NFIB small business optimism index dropped to a level of 103.6 in June, more than market expectations for a fall to a level of 104.4 and compared to a reading of 104.5 in the previous month. Further, the nation’s JOLTS job openings eased more-than-anticipated to a level of 5666.0K in May, compared to a revised reading of 5967.0K in the previous month, while investors had envisaged for a fall to a level of 5950.0K.

On the other hand, the seasonally adjusted final wholesale inventories rebounded more than initially anticipated by 0.4% in May, posting its largest gain in five months and compared to a gain of 0.3% recorded in the preliminary figures. In the prior month, wholesale inventories had recorded a revised drop of 0.4%.

Separately, the Federal Reserve (Fed) Governor, Lael Brainard, stated that the central bank would begin to unwind its balance sheet “soon” if the labour market continues to tighten and economy remains on the growth path. However, she expressed caution about further rate increases amid a slowdown in inflation. On the other hand, the San Francisco Fed President, John Williams, downplayed recent slowdown in inflation and advocated for another interest rate hike this year.

In the Asian session, at GMT0300, the pair is trading at 1.1478, with the EUR trading 0.07% higher against the USD from yesterday’s close.

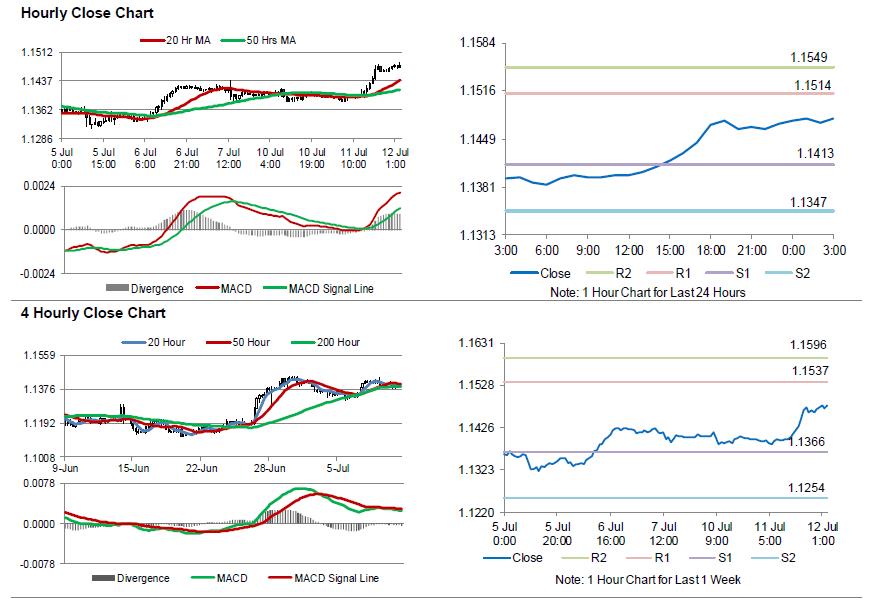

The pair is expected to find support at 1.1413, and a fall through could take it to the next support level of 1.1347. The pair is expected to find its first resistance at 1.1514, and a rise through could take it to the next resistance level of 1.1549.

Going ahead, investors will look forward to the Euro-zone’s industrial production data for May, slated to release in a few hours. Moreover, market participants will closely monitor remarks by Federal Reserve (Fed) Chairwoman, Janet Yellen, to receive any guidance about the central bank’s monetary policy trajectory.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.