For the 24 hours to 23:00 GMT, the EUR declined 0.67% against the USD and closed at 1.1241, as uncertainty continued regarding Greece’s debt woes.

The greenback gained ground, after the US retail sales rose in May, indicating that the US economy is gathering steam.

Data showed that US advance retail sales rose 1.2% in May, in line with market expectations and compared to a revised 0.2% increase in April. On the other hand, initial jobless claims in the nation rose to a level of 279.00 K in the week ended 06 June, following a revised level of 277.00 K in the previous week.

Other economic data showed that business inventories climbed 0.4% in April, compared to a rise of 0.1% in the previous month.

Yesterday, the World Bank downgraded its global economic growth forecast to 2.8% for 2015, following a 3.0% expansion it predicted in January. Additionally, it urged the US Fed to keep interest rates unchanged until 2016, amid increasing expectations that the Fed might raise them as early as September.

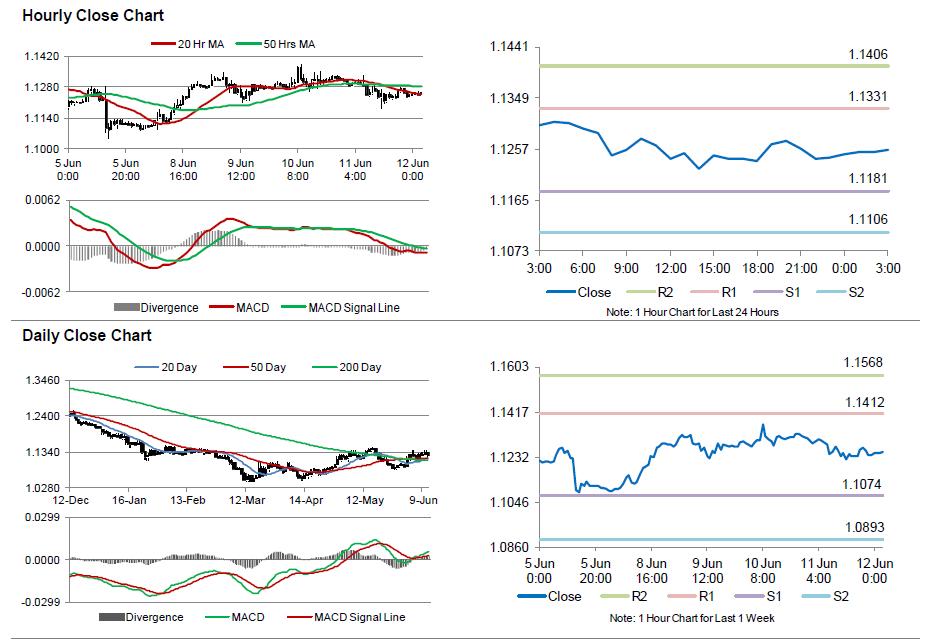

In the Asian session, at GMT0300, the pair is trading at 1.1256, with the EUR trading 0.13% higher from yesterday’s close.

The pair is expected to find support at 1.1181, and a fall through could take it to the next support level of 1.1106. The pair is expected to find its first resistance at 1.1331, and a rise through could take it to the next resistance level of 1.1406.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s industrial production data, scheduled in a few hours. Additionally, the US consumer sentiment index would also generate lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.