On Friday, the EUR declined 0.12% against the USD and closed at 1.2445.

In economic news, German retail sales rose 1.9% on a monthly basis, marking its biggest rise since June 2011 in October. Meanwhile, the core consumer price index in the Euro-zone remained unchanged at 0.7% on a monthly basis in November, in line with market expectations, while the region’s jobless rate remained flat at a level of 11.5% in October, at par with market forecasts.

Elsewhere, in Italy, unemployment rate recorded an unexpected rise to a level of 13.2% in October, higher than market expectations of a fall to a level of 12.6%, while the flash consumer price index eased 0.2% on a MoM basis in November, compared to a rise of 0.1% in the prior month. Markets were expecting the index to drop 0.4%. On the other hand, Spanish retail sales climbed 1.0% on a YoY basis in October, less than market expectations for a rise of 2.0%.

Separately, the ECB policymaker, Jens Weidmann stated that it would be illusory for markets to think that the central bank’s monetary policy could spur sustainable growth or create jobs in the economy.

In the US, the NAPM-Milwaukee manufacturing index recorded an unexpected rise to a level of 70.2 in November, compared to a level of 65.6 in the previous month, while market anticipations were for the index to drop to 64.0.

In the Asian session, at GMT0400, the pair is trading at 1.2454, with the EUR trading 0.07% higher from Friday’s close.

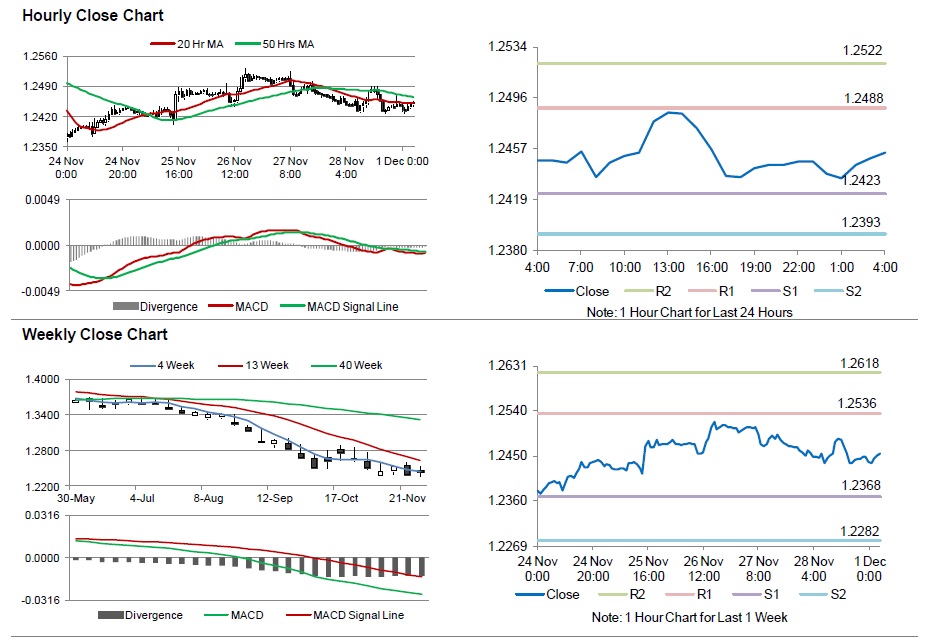

The pair is expected to find support at 1.2423, and a fall through could take it to the next support level of 1.2393. The pair is expected to find its first resistance at 1.2488, and a rise through could take it to the next resistance level of 1.2522.

Trading trends in the Euro today are expected to be determined by the manufacturing PMI data from the Euro-zone and its peripheries, scheduled in a few hours. Meanwhile, investors would keep a tab on the US ISM manufacturing PMI reading for November to get a broader insight into the nation’s macro conditions for the last quarter of 2014, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.