For the 24 hours to 23:00 GMT, the EUR rose 0.57% against the USD and closed at 1.2380, after the ECB failed to provide immediate stimulus measures and following upbeat construction and retail PMI data in Germany.

Data showed that Germany’s construction PMI edged up to 53.5 in November from a level of 51.5 registered in the prior month, while the nation’s retail PMI jumped to 52.8 in November, compared to a reading of 50.2 registered October.

Yesterday, the ECB held its key interest rate steady at 0.05% at the bank’s monthly meeting, in line with market expectations. Additionally, the ECB Chief, Mario Draghi in a statement following the ECB’s policy decision indicated that policymakers would reassess the central bank’s stimulus measures early next year and then only decide whether the Euro-economy would be in need of additional stimulus measures. Furthermore, he hinted that the ECB would act even if it does not find unanimity among policymakers.

Elsewhere, in France, the ILO unemployment rate climbed to 10.4% in 3Q 2014, compared to a level of 10.1% in the prior quarter.

The greenback traded on a weaker footing, following disappointing weekly initial jobless claims data in the US.

The seasonally adjusted initial jobless claims fell to a level of 297.0 K in the week ended 29 November 2014, less than market expectations of a drop to 295.0 K. In the previous week, it had recorded a revised reading of 314.0 K. Additionally, the nation’s continuing jobless claims advanced unexpectedly to 2362.0 K in the week ended 22 November 2014, compared to market expectations of a fall to 2318.0 K. Meanwhile, number of planned layoffs by the US companies fell 20.7% in November, while layoffs had recorded a rise of 11.9% in the previous month.

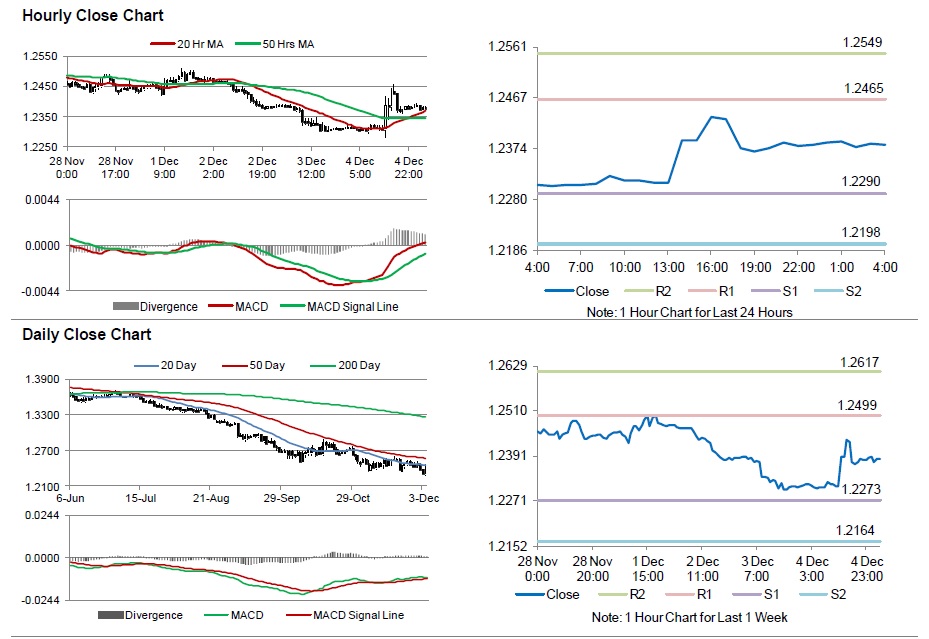

In the Asian session, at GMT0400, the pair is trading at 1.2382, with the EUR trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.2290, and a fall through could take it to the next support level of 1.2198. The pair is expected to find its first resistance at 1.2465, and a rise through could take it to the next resistance level of 1.2549.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s Q3 GDP data, scheduled in a few hours. Meanwhile, the US crucial non-farm payrolls as well as unemployment rate data would keep investors on their toes, scheduled later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.