For the 24 hours to 23:00 GMT, the EUR rose 0.30% against the USD and closed at 1.1179, on the back of upbeat assessment of the European economy by the European Commission.

Yesterday, the European Commission (EC) reported that the European economy was gaining momentum and revised upward its forecast for the Euro-zone’s economic growth to 1.5% in 2015 from 1.3% predicted earlier, on the back of lower oil prices, a weaker Euro and quantitative easing measures. For 2016, the EC kept its forecast unchanged at 1.9% for the common-currency bloc.

In other economic news, the producer price index (PPI) in the Euro-zone climbed 0.20% on a monthly basis in March, lower than market expectations for a rise of 0.30%. The index had risen by a revised 0.60% in the previous month.

In the US, the ISM non-manufacturing PMI jumped to 5-month high of 57.8 in April, above market forecasts for a reading of 56.2 and up from a level of 56.5 registered in March. Meanwhile, the nation’s trade deficit widened to $51.4 billion in March, compared to a revised deficit of $35.9 billion in the previous month. Markets were anticipating the nation to post a trade deficit of $41.7 billion.

Separately, the Minneapolis Fed President, Narayana Kocherlakota reiterated that the Fed should not hike rates until 2016. He further added that the US central bank can best achieve its objectives by keeping rates steady during the current year.

In the Asian session, at GMT0300, the pair is trading at 1.1213, with the EUR trading 0.3% higher from yesterday’s close.

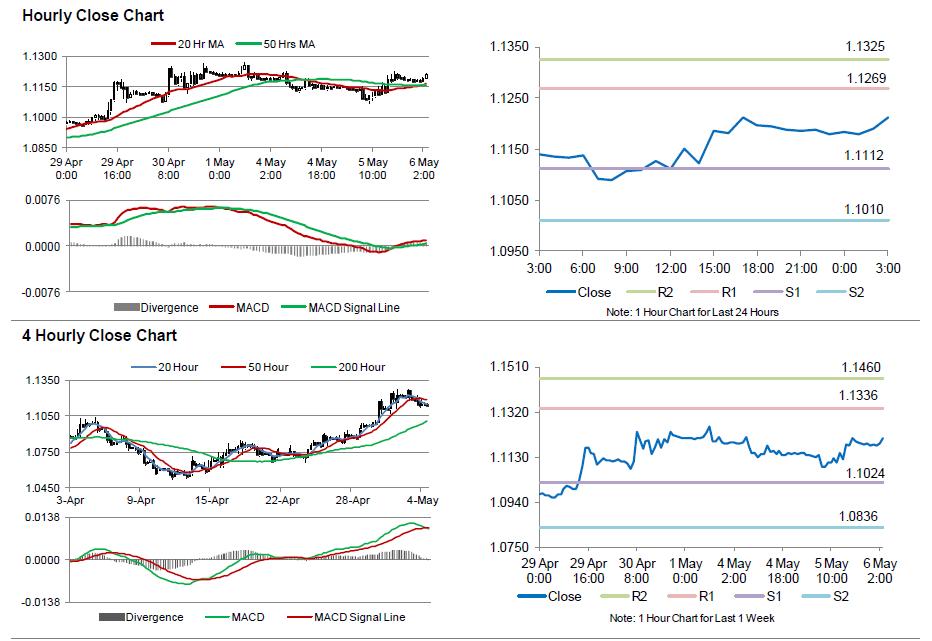

The pair is expected to find support at 1.1112, and a fall through could take it to the next support level of 1.1010. The pair is expected to find its first resistance at 1.1269, and a rise through could take it to the next resistance level of 1.1325.

Trading trends in the pair today are expected to be determined by the Euro-zone’s services PMI coupled with retail sales data scheduled in a few hours. Meanwhile, the US ADP employment data, scheduled later in the day would also be monitored by the market participants.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.