For the 24 hours to 23:00 GMT, the EUR declined 1.00% against the USD and closed at 1.0821.

In economic news, the Euro-zone’s Sentix consumer confidence improved to a level of 20.0, registering the highest level in nearly seven-and-a-half years in April and compared to prior month’s reading of 18.6 in the prior month.

Other economic data indicated that, Germany’s final services PMI climbed to 55.40 in March, higher than market expectations of an advance to 55.30, thus indicating signs of strengthening in the Euro-zone’s biggest economy.

In the US, consumer credit rose $15.52 billion in February, compared to a revised advance of $10.80 billion in the prior month. Market anticipations were for it to climb $12.65 billion. Meanwhile, JOLTs job openings advanced to 5133.00 K in February, higher than market expectations of an advance to a level of 5003.00 K and following a revised level of 4965.00 K recorded in the prior month.

Separately, the Minneapolis Fed President, Narayana Kocherlakota, opined that the central bank should wait until the latter half of 2016 before raising US interest rates and further suggested that rates in the nation must gradually be raised to around 2% by the end of 2017.

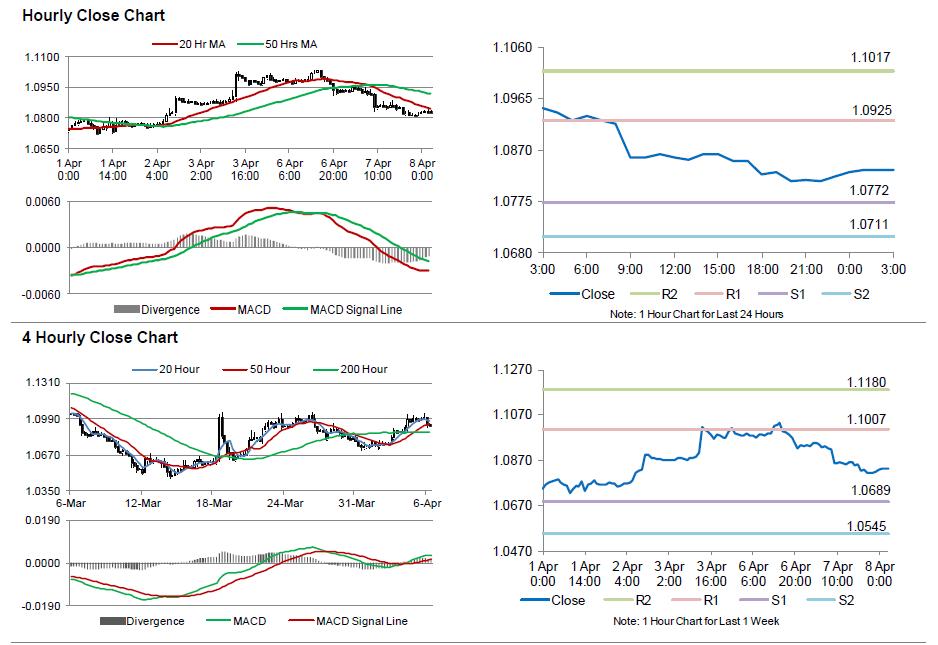

In the Asian session, at GMT0300, the pair is trading at 1.0834, with the EUR trading 0.11% higher from yesterday’s close.

The pair is expected to find support at 1.0772, and a fall through could take it to the next support level of 1.0711. The pair is expected to find its first resistance at 1.0925, and a rise through could take it to the next resistance level of 1.1017.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s retail sales data, scheduled in a few hours. Additionally, the US Fed minutes from its recent monetary policy meeting would be closely watched by the market participants, scheduled later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.