For the 24 hours to 23:00 GMT, the EUR declined 0.72% against the USD and closed at 1.0931.

The greenback gained ground, after the US final Markit services PMI unexpectedly climbed to 59.2, notching the fastest pace of expansion in the sector since August 2014 in March. Market expectations were for it to come in at 58.6, unchanged from the reading recorded in the preceding month.

Other economic data indicated that the nation’s non-manufacturing PMI eased to 56.50 in March, following a level of 56.9 in February.

Separately, the New York Fed President, William Dudley opined that the pace of central bank’s interest rate increases would largely depend on financial markets’ response to the rate hike. Further, he added that the recent weakness in the US labour market was temporary.

Data released on Friday showed that non-farm payrolls in the US climbed by 126.00 K, marking its weakest pace since December 2013 in March and following a revised advance of 264.00 K in the previous month. Markets were expecting non-farm payrolls to advance 248.00 K. Meanwhile, the nation’s unemployment rate remained unchanged at 5.5% in March, at par with market expectations.

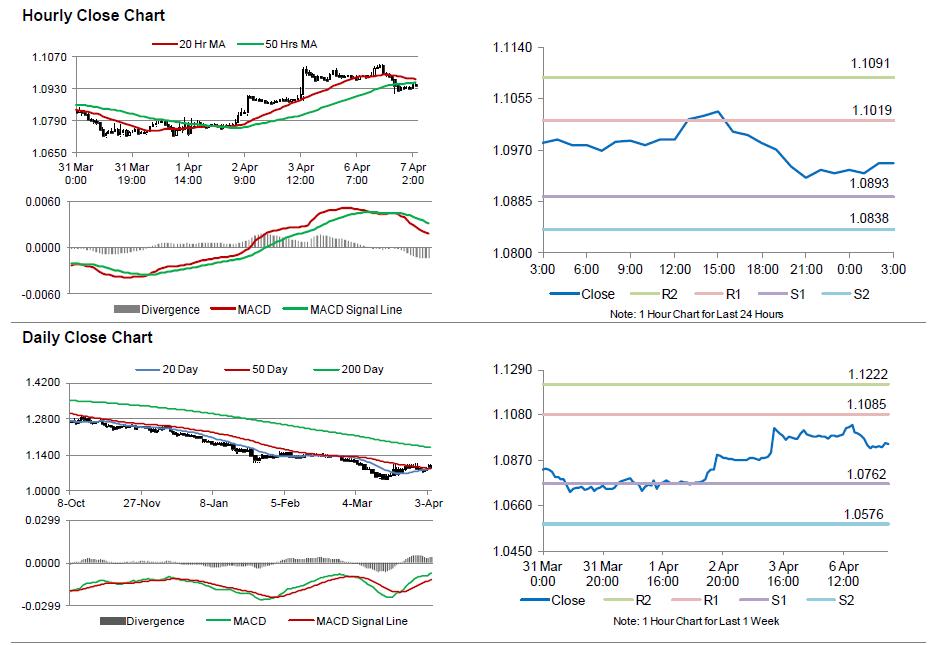

In the Asian session, at GMT0300, the pair is trading at 1.0948, with the EUR trading 0.15% higher from yesterday’s close.

The pair is expected to find support at 1.0893, and a fall through could take it to the next support level of 1.0838. The pair is expected to find its first resistance at 1.1019, and a rise through could take it to the next resistance level of 1.1091.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s Sentix investor confidence coupled with the region’s final Markit services PMI data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.