On Friday, EUR declined 1.24% against the USD and closed at 1.2513, the Euro-zone’s services PMI fell to 52.4 in September, after registering a reading of 53.1 in the prior month. Elsewhere, the services PMI in Italy registered a drop to 48.8 in September, further slipping into contraction territory. The services PMI data from France and Spain also eased more than expected in the same month.

On the other hand, the services PMI in Germany, Euro-zone’s biggest economy advanced to 55.7 in September, exceeding market expectations for the index to rise to 55.4 and compared to a level of 54.9 in August. The Euro-region’s seasonally adjusted retail sales grew 1.2%, on a monthly basis, in August, higher than market expectations for a rise of 0.1%. It follows a revised drop of 0.4% recorded in the previous month.

In the US, the non-farm payrolls climbed by 248.0K in September, beating market expectations for a rise of 215.0K jobs and compared to previous month’s revised increase of 180.0K jobs, underlining improvement in the nation’s labour market conditions. Additionally, unemployment rate in the nation surprisingly dropped 5.9% in September, marking its lowest level since July 2008 and lower than market expectations for an increase of 6.1%. Also, the US trade deficit narrowed to $40.1 billion in August, following a revised deficit of $40.3 billion in the prior month, though markets were expecting a trade deficit of $40.7 billion.

Similarly, the ISM non-manufacturing PMI advanced to 58.6 in September, higher than market expectations for a level of 58.5 and following a reading of 59.6 in August. Meanwhile, the nation’s services PMI came in at 58.9 in September, after registering a level of 58.5 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.2517, with the EUR trading marginally higher from Friday’s close.

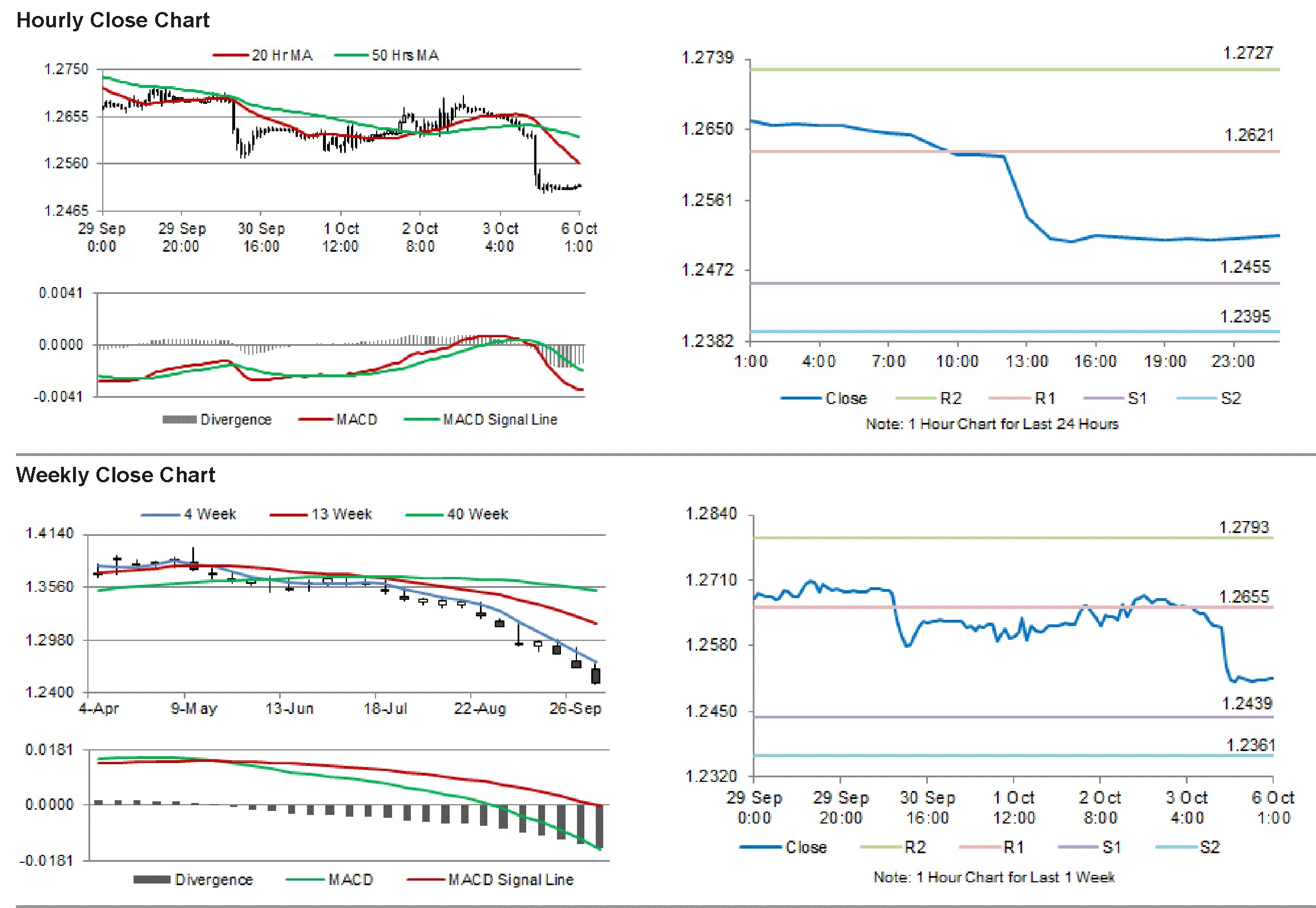

The pair is expected to find support at 1.2458, and a fall through could take it to the next support level of 1.2398. The pair is expected to find its first resistance at 1.2619, and a rise through could take it to the next resistance level of 1.272.

Trading trends in the Euro today would be mainly governed by Germany’s factory orders as well as the Euro-zone’s Sentix investor confidence data, scheduled in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.