For the 24 hours to 23:00 GMT, the EUR rose 0.28% against the USD and closed at 1.1318.

In economic news, the US Chicago Fed national activity index rose more-than-expected to a level of 0.27 in July, its 12-month high, compared to market expectations for an advance to a level of 0.20 and following a revised level of 0.05 in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.1331, with the EUR trading 0.11% higher against the USD from yesterday’s close.

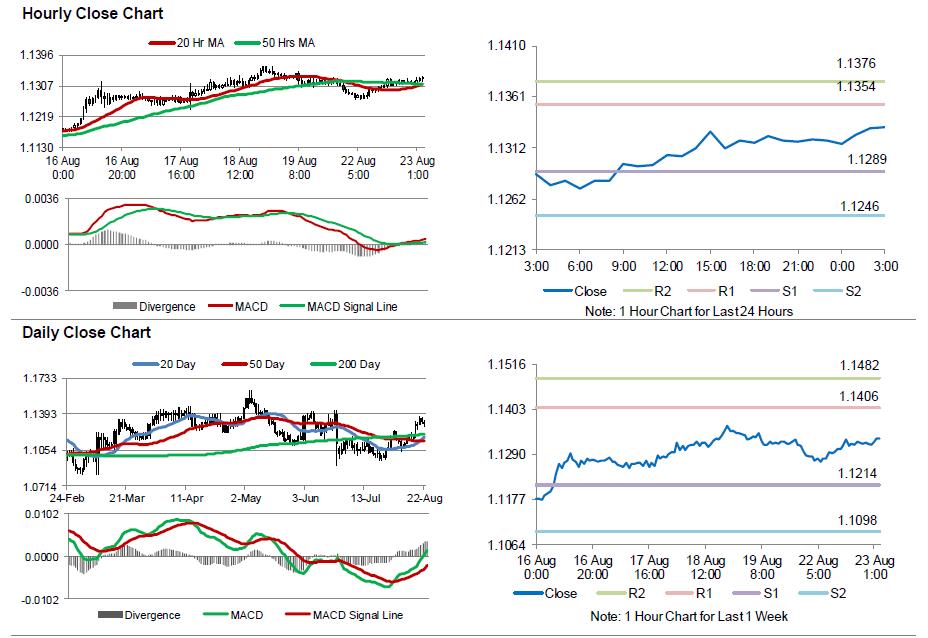

The pair is expected to find support at 1.1289, and a fall through could take it to the next support level of 1.1246. The pair is expected to find its first resistance at 1.1354, and a rise through could take it to the next resistance level of 1.1376.

Going ahead, investors will look forward to the preliminary Markit manufacturing and services PMI data for August across the Euro-zone, scheduled to release in a few hours. Separately, the US flash Markit manufacturing PMI data for August, is also due later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.