For the 24 hours to 23:00 GMT, the EUR rose 0.12% against the USD and closed at 1.1214, after the Euro-zone’s seasonally adjusted current account surplus widened to a four-month high level of €27.3 billion in March, from a revised surplus of €19.2 billion in the previous month. Meanwhile, on an annual basis, German producer prices declined more-than-expected by 3.1% in April, dropping for the 33rd consecutive month, mainly led by a drop in fuel prices, after registering a similar fall in the previous month. Market participants had expected it to decline by 3.0%. However, producer prices, on a monthly basis, recorded its first increase since April 2015, advancing in line with market expectations by 0.1% MoM in April, following a flat reading in the previous month.

In the US, existing home sales registered a rise of 1.7% MoM in April to a three-month high level of 5.45 million, compared to a revised level of 5.36 million in the prior month. Markets were anticipating existing home sales to advance to a level of 5.40 million.

In the Asian session, at GMT0300, the pair is trading at 1.1228, with the EUR trading 0.12% higher from Friday’s close.

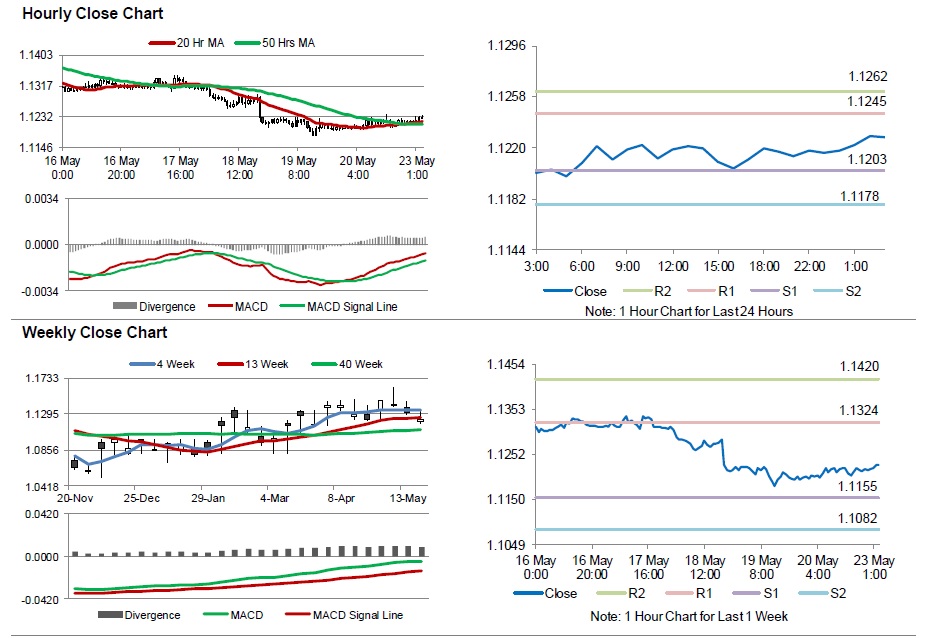

The pair is expected to find support at 1.1203, and a fall through could take it to the next support level of 1.1178. The pair is expected to find its first resistance at 1.1245, and a rise through could take it to the next resistance level of 1.1262.

Going ahead, investors will look forward to the preliminary Markit manufacturing and services PMI data across the Euro-zone, scheduled to release in a few hours. Moreover, the US flash Markit manufacturing PMI data, due later in the day, will also attract a significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.