For the 24 hours to 23:00 GMT, the EUR rose 0.11% against the USD and closed at 1.2850.

In economic news, consumer confidence in the Euro-zone fell for the fourth straight month in September to a level of -11.4, marking its lowest reading since February and compared to -10.0 in August, thus reflecting disappointment in the pace of recovery in the common-currency region. Analysts had expected the index to fall to a reading of -10.5 in September.

Yesterday, the ECB Chief, Mario Draghi, stated that economic recovery in the Euro-zone is lacking momentum and added that the central bank is ready to use unconventional tools to improve inflation and growth in the ailing Euro-zone economy. He further opined that there will be more demand from banks for its loan programme, known as TLTROs, when the funding is offered again in December.

Separately, the ECB Chief Economist, Peter Praet stated that the central bank is not trying to push the Euro lower to support the region’s fragile economy and stressed that the Euro-zone should have its own single representation at the International Monetary Fund.

Elsewhere, the Deutsche Bundesbank, in its monthly report, indicated that the German business climate is positive amid good labour market conditions and as end consumers did not adjust their income expectations and consumption intentions.

In the US, sales of existing homes unexpectedly eased 1.8%, on a monthly basis, in August, compared to previous month’s 2.2% revised rise, thus dampening optimism over the health of the housing market in the nation. Market expectations were for it to rise 1% in August. Additionally, the Chicago Fed national activity index unexpectedly dropped to -0.21 in August, lower than market expectations of a rise to 0.33 and compared to previous month’s revised level of 0.26.

In the Asian session, at GMT0300, the pair is trading at 1.2853, with the EUR trading marginally higher from yesterday’s close.

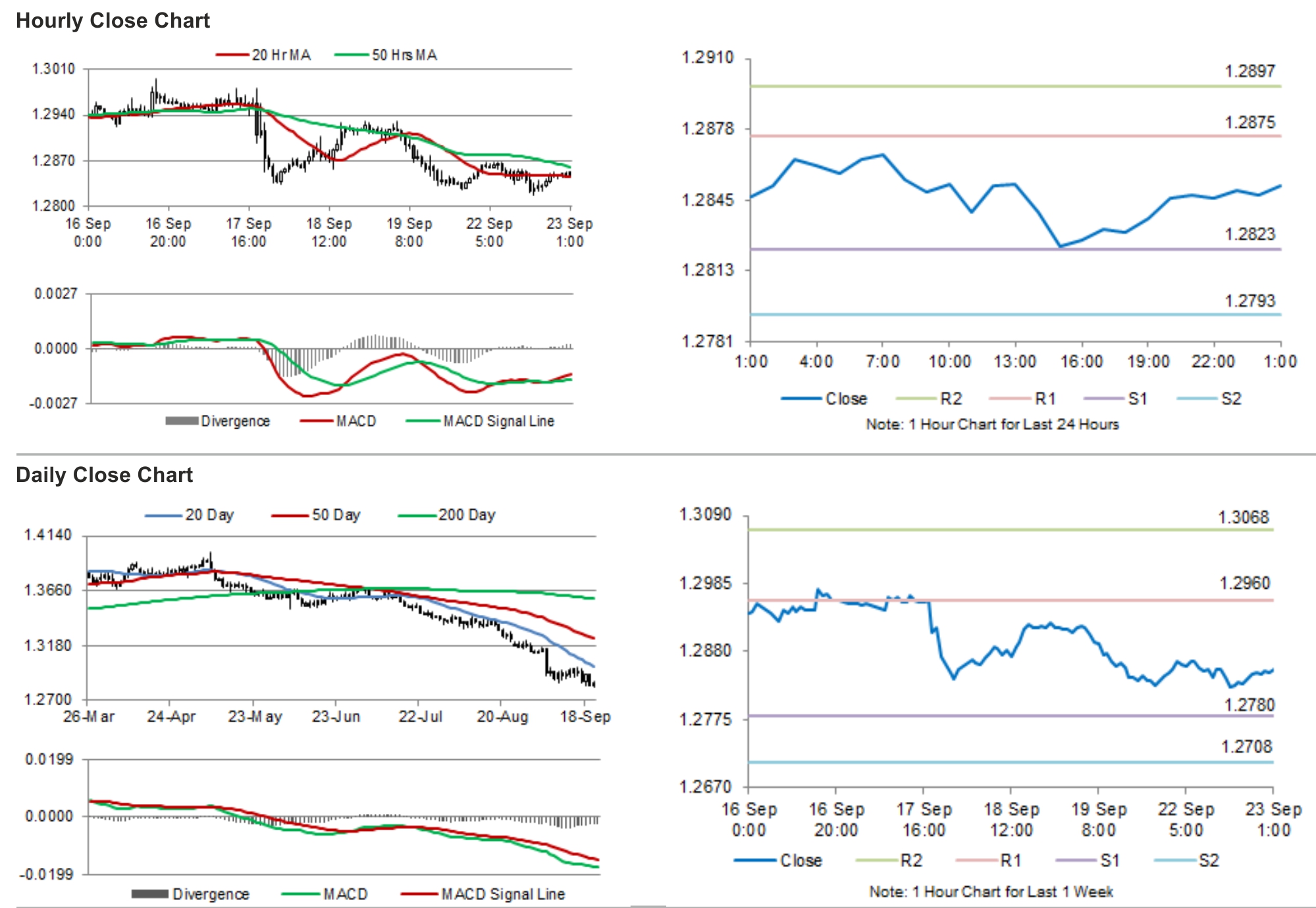

The pair is expected to find support at 1.2823, and a fall through could take it to the next support level of 1.2794. The pair is expected to find its first resistance at 1.2875, and a rise through could take it to the next resistance level of 1.2898.

Trading trends in the Euro today are expected to be determined by the Markit manufacturing and services PMI data from Germany and France as well as Euro-zone, slated to release later in the day. The French GDP data would also be awaited by investors.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.