For the 24 hours to 23:00 GMT, the EUR rose 0.49% against the USD and closed at 1.0979.

On the data front, Italy’s final consumer price index rose 1.9% on an annual basis in April, compared to a gain of 1.8% recorded in the preliminary print. In the prior month, the CPI had recorded a rise of 1.4%.

In the US, data indicated that the housing market index unexpectedly advanced to a level of 70.0 in May, pointing towards strengthening housing market. compared to market expectations for the index to remain steady at 68.0. On the contrary, the nation’s New York Empire State manufacturing index surprisingly fell to a seven-month low level of -1.0 in May, defying investor consensus for an advance to a level of 7.5. In the previous month, the index had registered a reading of 5.2.

In the Asian session, at GMT0300, the pair is trading at 1.0988, with the EUR trading 0.08% higher against the USD from yesterday’s close.

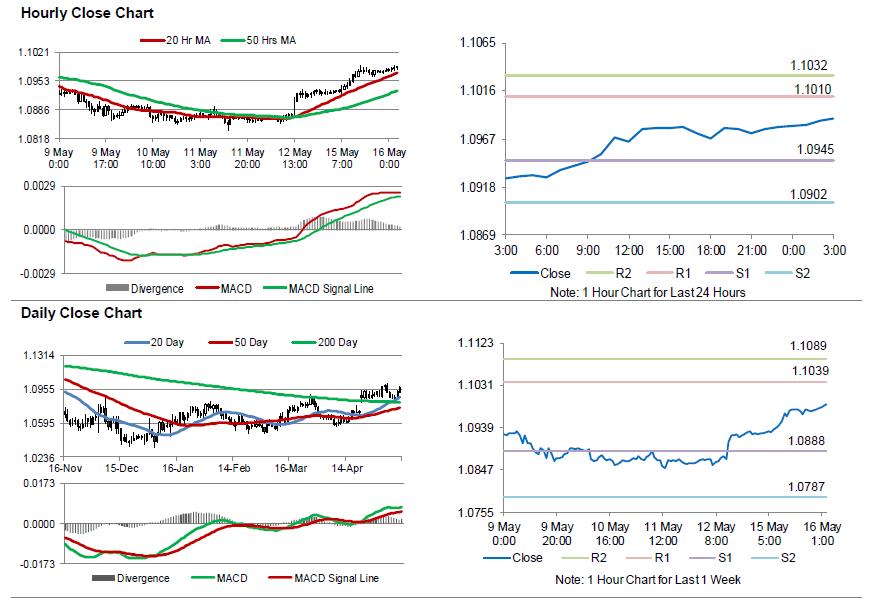

The pair is expected to find support at 1.0945, and a fall through could take it to the next support level of 1.0902. The pair is expected to find its first resistance at 1.1010, and a rise through could take it to the next resistance level of 1.1032.

Moving ahead, market participants await the release of ZEW survey of economic sentiment for May, across the Euro-zone along with the Euro-zone’s flash 1Q GDP numbers and trade balance figures for March, slated to release in a few hours. Moreover, the US housing starts, building permits, industrial as well as manufacturing production, all for April, scheduled to release later in the day, will pique significant amount of investor attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.