For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.2938, after the Euro-zone’s trade surplus narrowed to €12.2 billion in July, lower than market expectations to register a surplus of €15.5 billion and compared to €13.8 billion surplus registered in the previous month.

Separately, the Organization for Economic Co-operation and Development (OECD) cut its growth forecasts for major developed economies. It further indicated that the Euro-zone’s low inflation and geopolitical tensions have dented the global economic growth prospect. Additionally, it urged the ECB to come up with more aggressive measures to get rid of deflation risks prevailing in the single currency region.

In the US, industrial production unexpectedly fell 0.1% in August, registering its first decline since January, while manufacturing production also registered an unexpected drop of 0.4% in the same month, thus showing signs of uneven improvement in the US economy. Additionally, capacity utilization in the nation dropped to 78.8% in August, compared to a reading of 79.2% in the prior month. Markets were expecting it to advance to a level of 79.3%. Meanwhile, the NY Empire State manufacturing index climbed to 27.54 in September, beating market expectations of a rise to a level of 15.95 and up from previous month’s reading of 14.69.

In the Asian session, at GMT0300, the pair is trading at 1.2942, with the EUR trading tad higher from yesterday’s close.

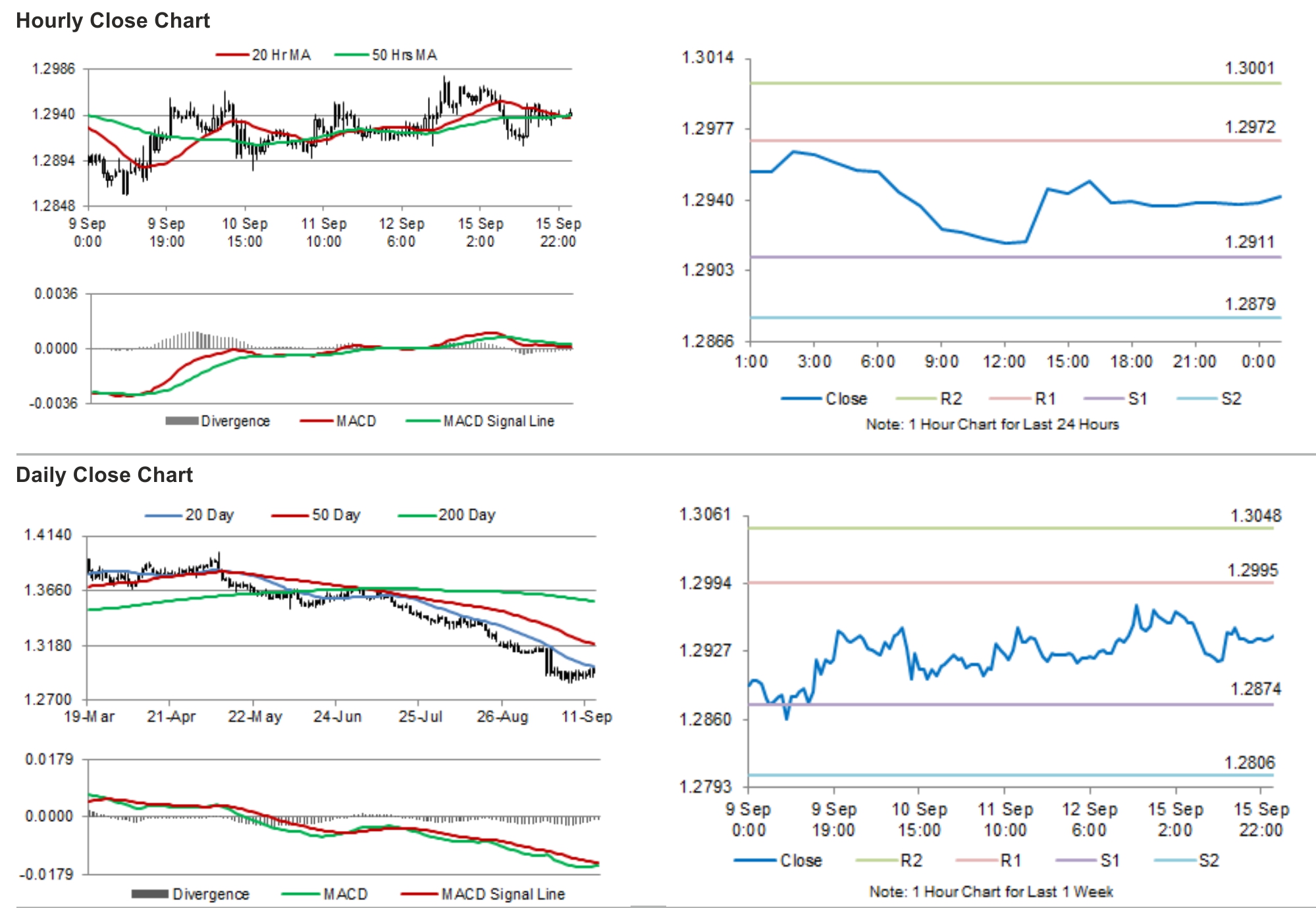

The pair is expected to find support at 1.2911, and a fall through could take it to the next support level of 1.2879. The pair is expected to find its first resistance at 1.2972, and a rise through could take it to the next resistance level of 1.3001.

Trading trends in the Euro today are expected to be determined by the ZEW’s economic survey for Germany as well as for Euro-zone as a whole, scheduled in a few hours.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.