For the 24 hours to 23:00 GMT, EUR rose 0.30% against the USD and closed at 1.4125, after the report that China and other Asian countries are interested in buying Portuguese bailout bonds. However, gains were capped, after President of the Eurogroup of finance ministers, Jean-Claude Juncker, stated that Greece won’t reach its 2011 budget deficit goal, and that the International Monetary Fund may withhold the next tranche of Greece’s bailout funds.

In the Euro zone, the conference board’s leading economic index, on a monthly basis, rose by 0.4% to post a reading of 109.0 in April, following a 0.5% decline recorded in March.

The European Central Bank President Jean-Claude Trichet stated that ECB’s primary mandate is to maintain price stability and that it is carefully monitoring the situation amid increased inflation risk.

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4210, 0.60% higher from the levels yesterday at 23:00GMT.

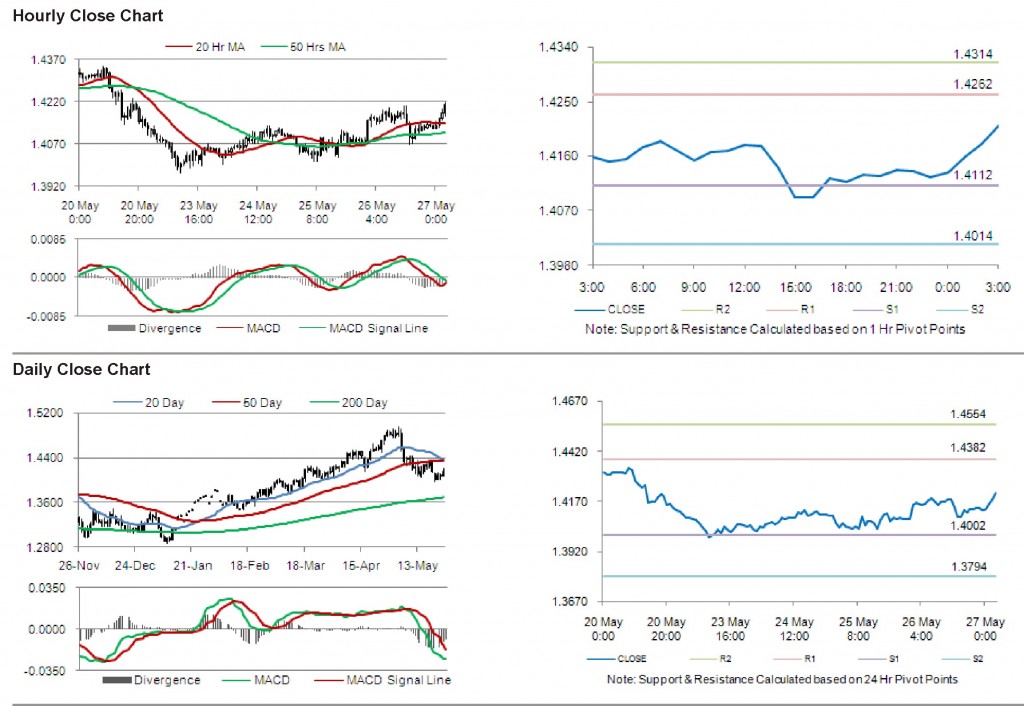

The pair has its first short term resistance at 1.4262, followed by the next resistance at 1.4314. The first support is at 1.4112, with the subsequent support at 1.4014.

With a series of Euro Zone economic releases today, including money supply and consumer confidence, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just above its 20 Hr and its 50 Hr moving averages.