For the 24 hours to 23:00 GMT, the EUR rose 0.36% against the USD and closed at 1.1133.

The US dollar declined against its major peers, after the US Federal Reserve (Fed) left its monetary policy unchanged and hinted that interest rates would continue to remain at its current level throughout 2020.

In the US, the consumer price index (CPI) advanced 2.1% on an annual basis in November, marking its highest level 12-months and compared to a rise of 1.8% in the prior month. Market participants had anticipated the CPI to record an increase of 2.0%. Moreover, the nation’s mortgage applications climbed 3.8% in the week ended 06 December 2019, compared to a drop of 9.2% in the prior week. Meanwhile, the US budget deficit widened more-than-expected to $208.8 billion in November, following a deficit of $134.5 billion in the prior month. Market participants had envisaged the nation to post a deficit of $196.5 billion.

The Fed, in its latest monetary policy meeting, opted to leave its key interest rate unchanged in a target range of 1.5%-1.75%, as widely expected and signalled that rates would remain at its current range through 2020, amid strong economy and robust labour market. In a statement post-meeting, the Fed’s Chairman Jerome Powell stated that monetary policy is appropriately placed to supporting continued economic growth, a strong job market and inflation near its 2% target. Further, he stated that he would not consider increasing rates until inflation picks up significantly. Also, the chairman expressed optimism about the economy and indicated that he is now less worried about economic risks from the trade war or global slowdown.

In the Asian session, at GMT0400, the pair is trading at 1.1144, with the EUR trading 0.10% higher against the USD from yesterday’s close.

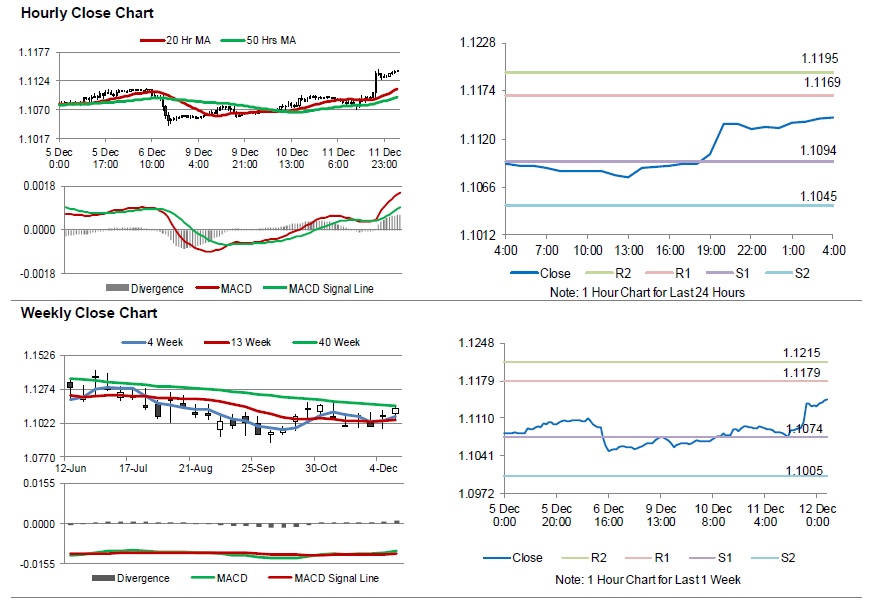

The pair is expected to find support at 1.1094, and a fall through could take it to the next support level of 1.1045. The pair is expected to find its first resistance at 1.1169, and a rise through could take it to the next resistance level of 1.1195.

Looking ahead, traders would await Euro-zone’s industrial production for October and Germany’s consumer price index for November along with the European Central Bank’s interest rate decision, all set to release in a few hours. Later in the day, the US producer price index for November followed by the initial jobless claims will keep investors on their toes.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.