For the 24 hours to 23:00 GMT, the EUR rose 0.14% against the USD and closed at 1.1326, following encouraging economic releases from Germany.

Data revealed that Germany’s trade surplus unexpectedly increased to its highest level of €19.1 billion in December 2014, following a surplus of €17.9 billion registered in prior month. Markets were expecting it to drop to €16.0 billion. Additionally, the nation’s current account surplus widened more than anticipated to €25.3 billion in December, against market expectations of €20.8 billion and following a revised level of €18.9 billion recorded in November. Meanwhile, German exports rebounded more than expected by 3.4% on a MoM basis in December, compared to a revised drop of 2.2% recorded in the prior month.

The Euro was further supported after the Euro-zone’s Sentix investor confidence surged more-than-expected to a 9-month high level of 12.4 in February, compared a reading of 0.9 registered in January, thus easing concerns over the economic outlook of the single-currency bloc.

In the Asian session, at GMT0400, the pair is trading at 1.1338, with the EUR trading 0.11% higher from yesterday’s close.

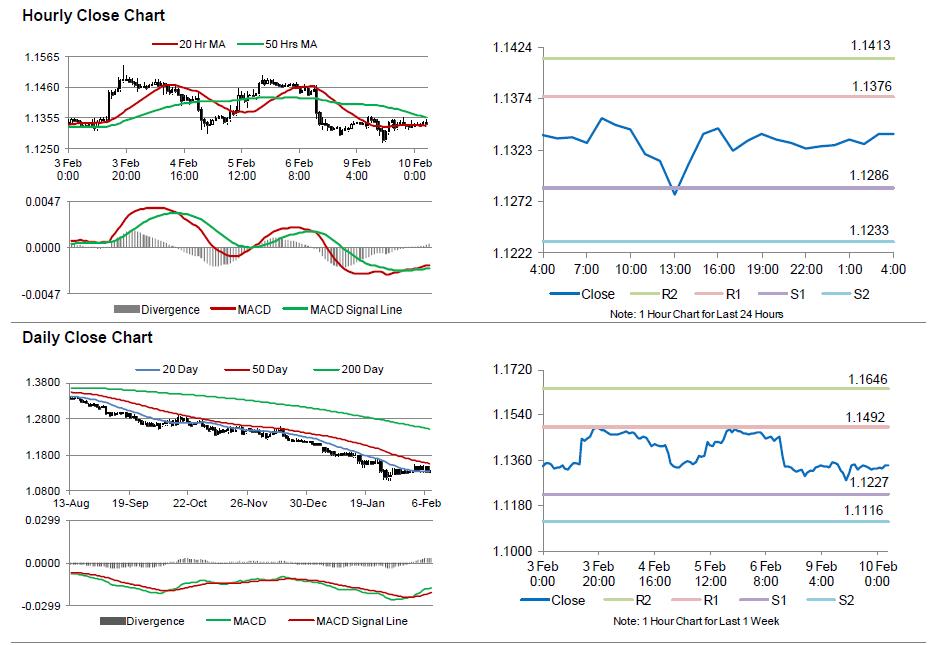

The pair is expected to find support at 1.1286, and a fall through could take it to the next support level of 1.1233. The pair is expected to find its first resistance at 1.1376, and a rise through could take it to the next resistance level of 1.1413.

Trading trends in the pair today are expected to be determined by global macroeconomic news.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.