On Friday, the EUR declined 0.12% against the USD and closed at 1.1389, as investors shrugged off better than expected GDP data in the Euro-zone and Germany, its biggest economy.

The preliminary GDP in Germany rose 0.70% QoQ in 4Q 2014, more than market expectations for a rise of 0.30%. In the previous quarter, GDP had climbed 0.10%, thus bolstering hopes that the nation’s economy was back on track. Additionally, the Euro-zone’s economy expanded 0.3% on a quarterly basis in 4Q 2014, beating market expectations for a 0.2% growth registered in the prior quarter as well.

Elsewhere, in France, the GDP advanced 0.1% on a quarterly basis in 4Q 2014, at par with market expectations.

Separately, the ECB’s Vice President Vitor Constancio warned that the prevailing low interest rates globally has caused overheating of some asset prices and measures need to be undertaken to control the rapid growth in the shadow banking sector.

In the US, the preliminary Reuters/Michigan consumer sentiment index dropped unexpectedly to a level of 93.60, defying market expectations of a steady reading. In the prior month, the index had registered a level of 98.10.

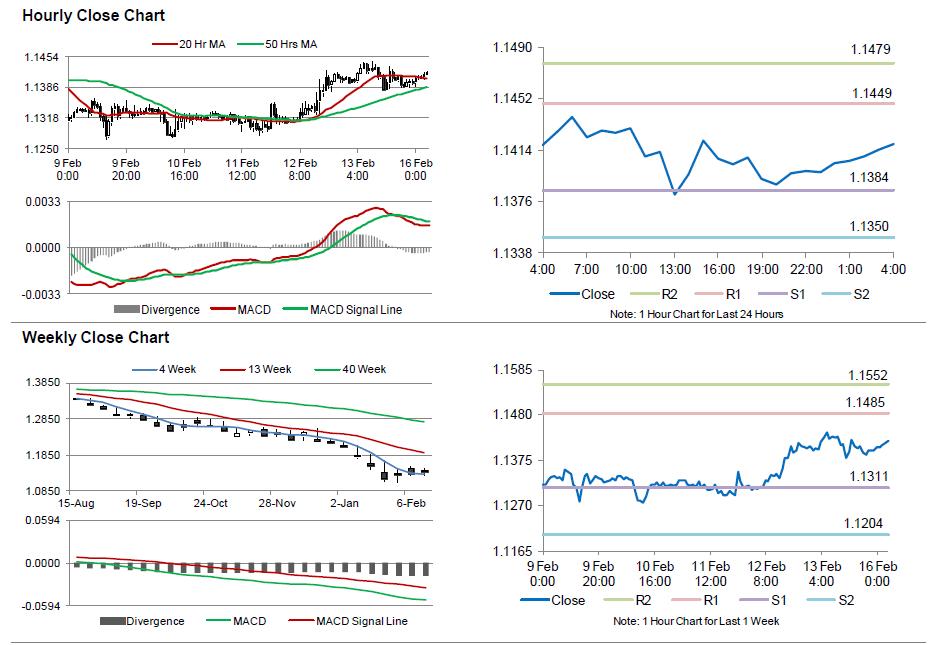

In the Asian session, at GMT0400, the pair is trading at 1.1419, with the EUR trading 0.26% higher from Friday’s close.

The pair is expected to find support at 1.1384, and a fall through could take it to the next support level of 1.1350. The pair is expected to find its first resistance at 1.1449, and a rise through could take it to the next resistance level of 1.1479.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s trade balance data, scheduled in few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.