For the 24 hours to 23:00 GMT, the EUR traded a tad lower against the USD and closed at 1.1180.

Losses were kept in check, after unemployment rate in the Euro-zone unexpectedly slid to a 33-month low of 11.2% in January, lower than market expectations for a rise to 11.4% and following previous month’s revised level of 11.3%. The Euro was also supported, after the region’s CPI eased less than expected by 0.3% YoY in February, compared to a drop of 0.6% recorded in the prior month.

Other economic data showed that, Germany’s Markit manufacturing PMI edged up to a level of 51.1 in February, after recording a reading of 50.9 in January. Meanwhile, the Euro-zone’s Markit manufacturing PMI unexpectedly fell to a level of 51.0 in February, from previous reading of 51.1.

In the US, the ISM manufacturing activity index recorded a drop to 52.90 in February, lower than market expectations of a fall to a level of 53.00. In the previous month, the index had registered a level of 53.50. Additionally, personal income in the nation registered a rise of 0.30% on a monthly basis in January, lower than market expectations for an advance of 0.40%.

Other economic data revealed that the final Markit manufacturing PMI in the US advanced to 55.10 in February. In the previous month, the index had registered a level of 53.90.

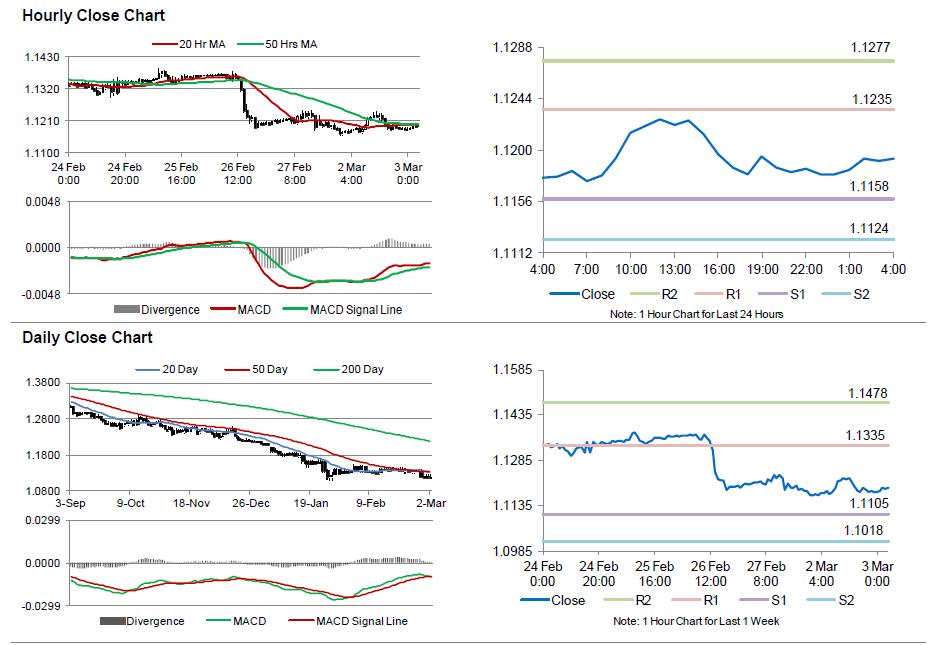

In the Asian session, at GMT0400, the pair is trading at 1.1193, with the EUR trading 0.12% higher from yesterday’s close.

The pair is expected to find support at 1.1158, and a fall through could take it to the next support level of 1.1124. The pair is expected to find its first resistance at 1.1235, and a rise through could take it to the next resistance level of 1.1277.

Trading trends in the Euro today are expected to be determined by Germany’s retail sales data

The currency pair is trading below its 20 Hr and 50 Hr moving averages.