For the 24 hours to 23:00 GMT, the EUR rose 0.26% against the USD and closed at 1.1373.

Yesterday, the Finance ministers of the 19-nation common-currency bloc failed to come out with a solution regarding Greece’s debt repayment to the IMF.

Separately, the IMF Chief, Christine Lagarde, warned that Greece cannot defer paying its debt, if the nation failed to make a payment by the month end.

The greenback lost ground, after the US consumer prices advanced less than expected on a monthly basis in May.

Data showed that the nation’s CPI rose 0.4% MoM in May, lower than expected gain of 0.5% and following a 0.1% rise in the previous month. On the other hand, the number of Americans filing for unemployment benefits for the first time dropped more than expected to a level of 267.0 K in the week ended 13 June, compared to prior week’s rise of 279.0 K.

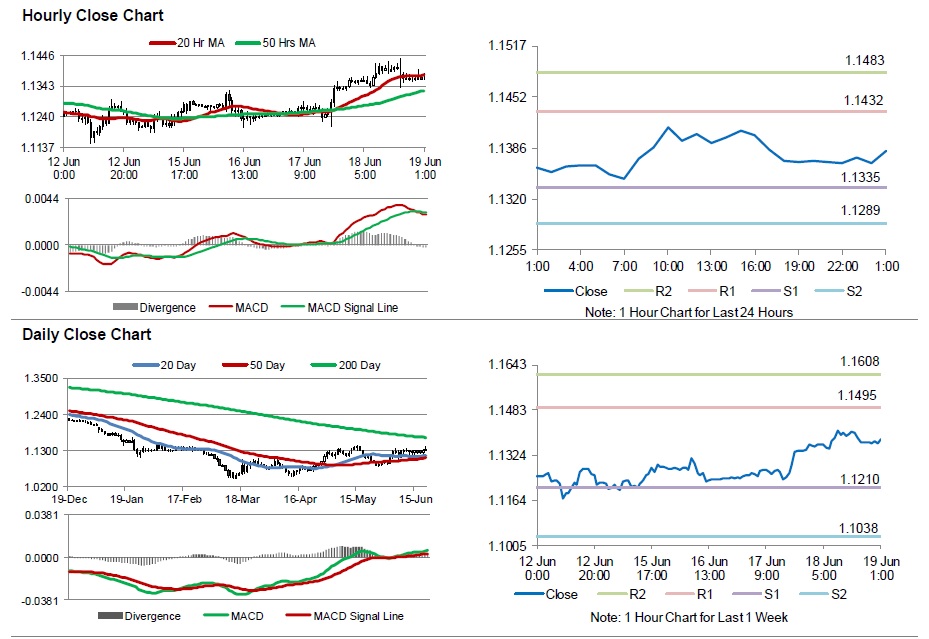

In the Asian session, at GMT0300, the pair is trading at 1.1382, with the EUR trading 0.08% higher from yesterday’s close.

The pair is expected to find support at 1.1335, and a fall through could take it to the next support level of 1.1289. The pair is expected to find its first resistance at 1.1432, and a rise through could take it to the next resistance level of 1.1483.

Next week’s consumer prices data from Germany as well as PMI figures from Euro-zone and its peripheries would be of keen attention to investors.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.