For the 24 hours to 23:00 GMT, the EUR declined 0.12% against the USD and closed at 1.1129, after the Euro-zone’s seasonally adjusted construction output fell by 0.6% MoM in December, compared to a revised gain of 0.9% in the previous month.

In the US, the Federal Reserve’s most recent meeting minutes revealed that, the policymakers were forced to keep the benchmark interest rate unchanged last month, due to uncertainty in global financial markets and sluggish inflation expectations. Further, the members expressed concerns that the turbulence in financial markets and slowdown in economic growth, especially in China, could hurt the US economy and thus considered altering the central bank’s planned interest rate hike path for 2016. The central bank also expressed worries that the improvements in US labour markets and household spending were overshadowed by disappointing US manufacturing data. At the same time, the policymakers did not rule out the possibility of an interest rate hike in the next month and reiterated that economic data will guide the pace of further interest rate hikes.

Meanwhile, the St. Louis Fed President, James Bullard, warned that it would be unwise to continue tightening monetary policy in the near-term, amid the nation’s weak inflation and recent global market volatility.

In other economic news, US industrial production climbed 0.9% in January, the largest gain since November 2014, from a revised drop of 0.7% in the previous month and more than investor expectations for a rise of 0.4%. On the other hand, housing starts unexpectedly fell by 3.8% MoM in January, while markets expected for a gain of 2.0% and following a revised fall of 2.8% in the previous month. Also, the nation’s building permits declined by 0.2% MoM in January, to an annual rate of 1202.0K. In the prior month, building permits had recorded a revised level of 1204.0K.

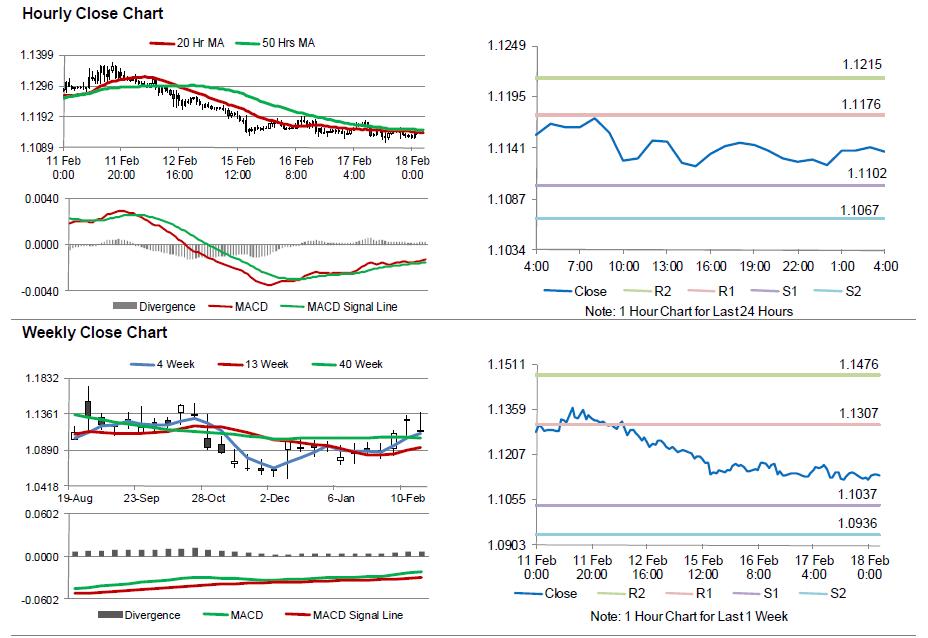

In the Asian session, at GMT0400, the pair is trading at 1.1137, with the EUR trading 0.07% higher from yesterday’s close.

The pair is expected to find support at 1.1102, and a fall through could take it to the next support level of 1.1067. The pair is expected to find its first resistance at 1.1176, and a rise through could take it to the next resistance level of 1.1215.

Going ahead, investors will look forward to the ECB’s monetary policy meeting accounts slated to release later in the day. Additionally, the US initial jobless claims data, due for release later today, will also be on investor’s radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.