For the 24 hours to 23:00 GMT, the EUR declined 0.18% against the USD and closed at 1.1126.

Yesterday, the European Central Bank, in its latest monthly economic bulletin report, warned that Britain’s decision to leave the European Union has triggered some volatility in global financial markets and increased uncertainty about the global economic outlook. It further revealed that economic recovery in the Euro-bloc is expected to proceed at a moderate pace and also noted that incoming economic data for second quarter pointed towards subdued global activity and trade.

In other economic news, Germany’s Markit construction PMI advanced to a level of 51.6 in July, compared to a level of 50.4 in the preceding month.

Macroeconomic data released in the US indicated that, the number of Americans filing for fresh unemployment benefits unexpectedly rose to a level of 269.0K in the week ended 30 July, compared to market expectations of a drop to a level of 265.0K and following a reading of 266.0K. Also, the nation’s factory orders fell for the second straight month, declining by 1.5% on a monthly basis in June, lower than market expectations for a fall of 1.9% and after recording a revised drop of 1.2% in the prior month. Further, final durable goods orders dropped by 3.9% MoM in June, compared to a revised fall of 2.8% in the prior month while markets anticipated it to ease by 4.0%.

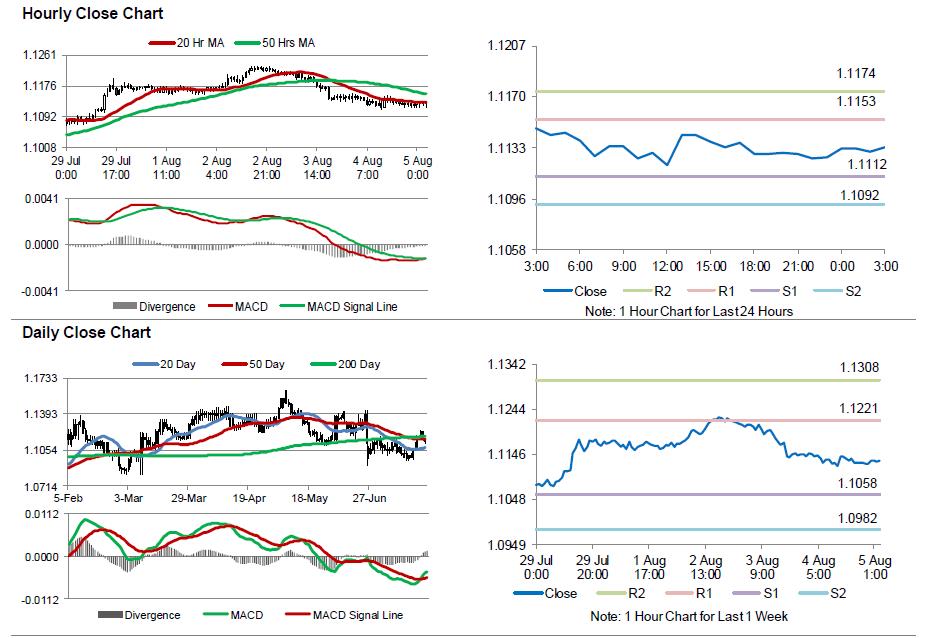

In the Asian session, at GMT0300, the pair is trading at 1.1133, with the EUR trading 0.06% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1112, and a fall through could take it to the next support level of 1.1092. The pair is expected to find its first resistance at 1.1153, and a rise through could take it to the next resistance level of 1.1174.

Moving forward, investors would concentrate on Germany’s factory orders for June, slated to release in a few hours. Moreover, in the US, non-farm payrolls, unemployment rate and Trade Balance data, due later today, will also keep investors on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.