For the 24 hours to 23:00 GMT, the EUR declined 0.82% against the USD and closed at 1.1151 on Friday.

In economic news, Italy’s trade surplus expanded to a level of €2.9 billion in July, following a revised trade surplus of €1.2 billion in the prior month.

The US Dollar gained ground, after the US consumer price index (CPI) advanced more-than-expected by 0.2% MoM in August, offering fresh signs that inflation in the world’s largest economy has started to pick up in the second half of this year. Market participants had expected CPI to advance by 0.1%, after registering a flat reading in the previous month. On the other hand, the nation’s flash Reuters/Michigan consumer sentiment index unexpectedly remained steady at a level of 89.8 in September, compared to market expectations for a rise to a level of 90.6.

In the Asian session, at GMT0300, the pair is trading at 1.1169, with the EUR trading 0.16% higher against the USD from Friday’s close.

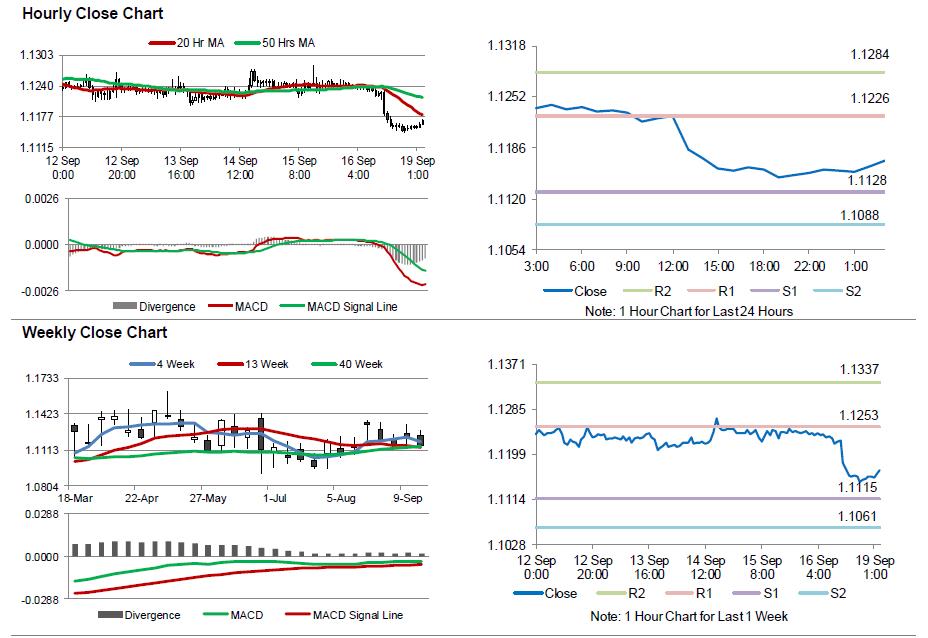

The pair is expected to find support at 1.1128, and a fall through could take it to the next support level of 1.1088. The pair is expected to find its first resistance at 1.1226, and a rise through could take it to the next resistance level of 1.1284.

Going ahead, investors would look forward to the Euro-zone’s current account and construction output data, scheduled to release in a few hours. Moreover, the US NAHB housing market index data, slated to release later today, would be closely watched by investors.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.