For the 24 hours to 23:00 GMT, the EUR marginally rose against the USD and closed at 1.0457.

On Friday, Germany’s GfK consumer confidence index edged higher to a level of 9.9 for January, in line with market expectations, supported by positive economic outlook and robust labour market. The index recorded a level of 9.8 in the prior month.

The US Dollar gained ground against its major peers yesterday, after upbeat US economic data reinforced hopes that US economy is strengthening at a faster pace.

Data indicated that the US consumer confidence index unexpectedly climbed to its highest level in more than fifteen years, after it surged to a level of 113.7 in December, as Americans are more upbeat about the nation’s growth prospects, labour market and incomes following the victory of Donald Trump in the US Presidential election. Markets expected the index to fall to a level of 109.0, after recording a revised reading of 109.4 in the previous month. Additionally, the nation’s Dallas Fed manufacturing index surprisingly advanced to a level of 15.5 in December, recording its sixth consecutive increase, while investors had envisaged the index to remain steady at 10.2. Moreover, the nation’s Richmond Fed manufacturing index rose to a level of 8.0 in December, higher than market expectations of an advance to a level of 5.0. The index had registered a reading of 4.0 in the previous month.

On Friday, the nation’s final Reuters/Michigan consumer sentiment index climbed to its highest level since January 2014, after it surprisingly jumped to a level of 98.2 in December, confounding market consensus for the index to remain steady at 98.0, recorded in the preliminary print and compared to a reading of 93.8 in the prior month. Further, the nation’s new home sales rebounded more-than-expected by 5.2% on a monthly basis in November, notching its highest level since July 2016 and suggesting that housing sector would contribute to the nation’s economic growth in the fourth quarter. Meanwhile, markets expected new home sales to gain 2.1%, after recording a revised drop of 1.4% in the preceding month.

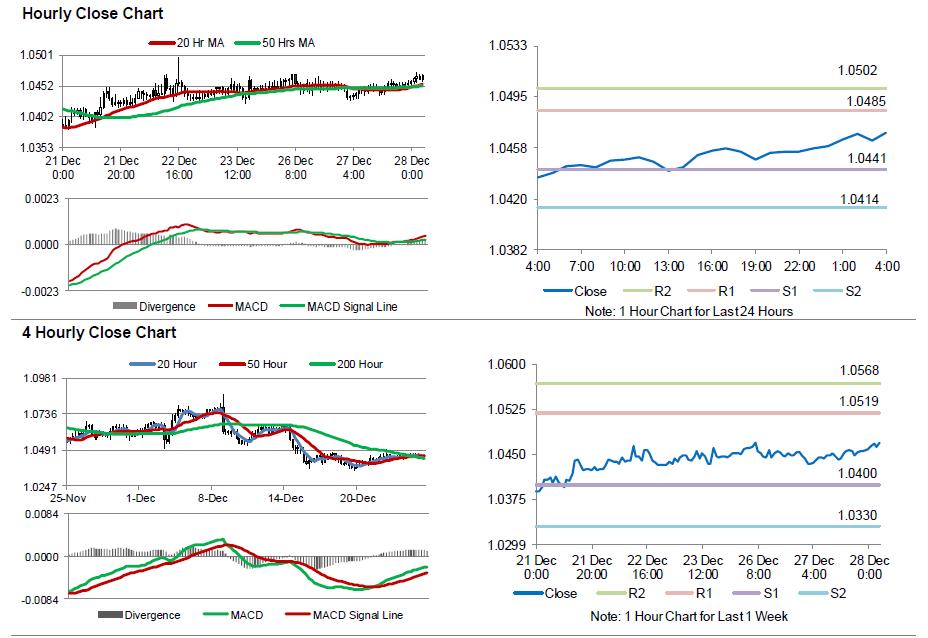

In the Asian session, at GMT0400, the pair is trading at 1.0469, with the EUR trading 0.11% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0441, and a fall through could take it to the next support level of 1.0414. The pair is expected to find its first resistance at 1.0485, and a rise through could take it to the next resistance level of 1.0502.

With no major economic releases in the Euro-zone today, investors will look forward to the US pending home sales for November and weekly mortgage applications, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.