For the 24 hours to 23:00 GMT, the EUR declined 0.22% against the USD and closed at 1.2232 on Friday.

On the macro front, Italy’s seasonally adjusted industrial production rose more-than-expected by 1.6% on a monthly basis in December, rising by the most in nearly 2 years. Industrial production had registered a revised gain of 0.2% in the prior month, while markets were expecting for an increase of 0.8%.

Separately, industrial production in France rebounded more-than-anticipated by 0.5% on a monthly basis in December, compared to a revised drop of 0.3% in the prior month. Markets were expecting industrial production to rise 0.1%.

In the US, data indicated that the seasonally adjusted final wholesale inventories climbed 0.4% MoM in December, more than a rise of 0.2% registered in the preliminary figures. In the prior month, the wholesale inventories had recorded a rise of 0.8%.

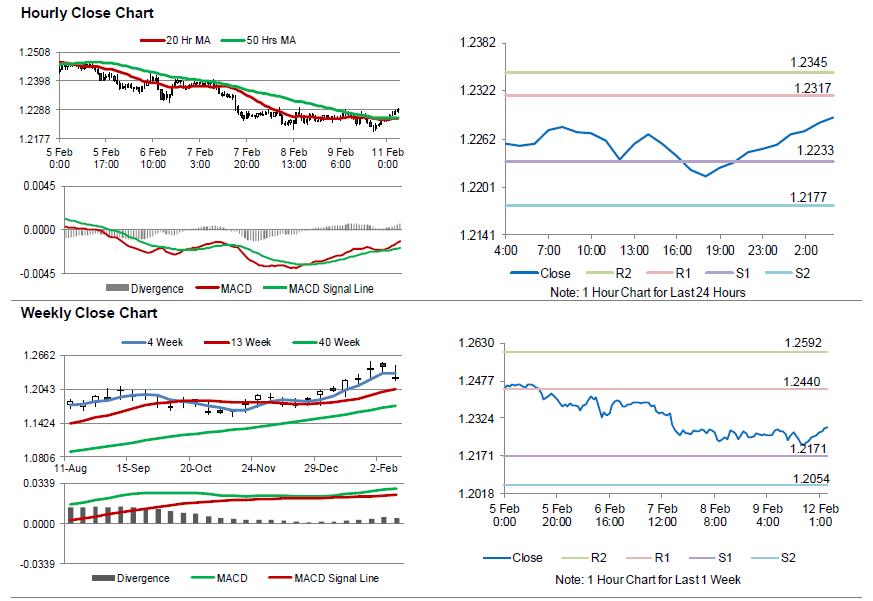

In the Asian session, at GMT0400, the pair is trading at 1.2288, with the EUR trading 0.46% higher against the USD from Friday’s close.

The pair is expected to find support at 1.2233, and a fall through could take it to the next support level of 1.2177. The pair is expected to find its first resistance at 1.2317, and a rise through could take it to the next resistance level of 1.2345.

In absence of crucial macroeconomic releases in the Euro-zone today, investors would keep a close watch on the US monthly budget statement for January, set to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.