For the 24 hours to 23:00 GMT, the EUR declined 1.02% against the USD and closed at 1.2407 on Friday.

On the macro front, Germany’s wholesale price index rose 0.9% on a monthly basis in January, beating market expectations for a rise of 0.2%. In the prior month, the wholesale price index had recorded a fall of 0.3%.

In the US, data showed that housing starts climbed more-than-anticipated by 9.70%, on a monthly basis, to an annual rate of 1326.0K in January, reaching its highest annual rate since October 2016 and compared to a revised level of 1209.0K in the previous month. Markets were expecting housing starts to rise to a level of 1234.0K. Additionally, building permits in the US unexpectedly rose 7.40%, on a monthly basis, to an annual rate of 1396.0K in January, hitting its highest level since June 2007. Building permits had recorded a revised reading of 1300.0K in the previous month, while investors had envisaged for a rise to a level of 1300.0K. Moreover, the flash Reuters/Michigan consumer sentiment index rose unexpectedly to 99.90 in February, marking its highest level in 14 years and higher than market expectations for a drop to a level of 95.40. In the previous month, the Reuters/Michigan consumer sentiment index had registered a reading of 95.70.

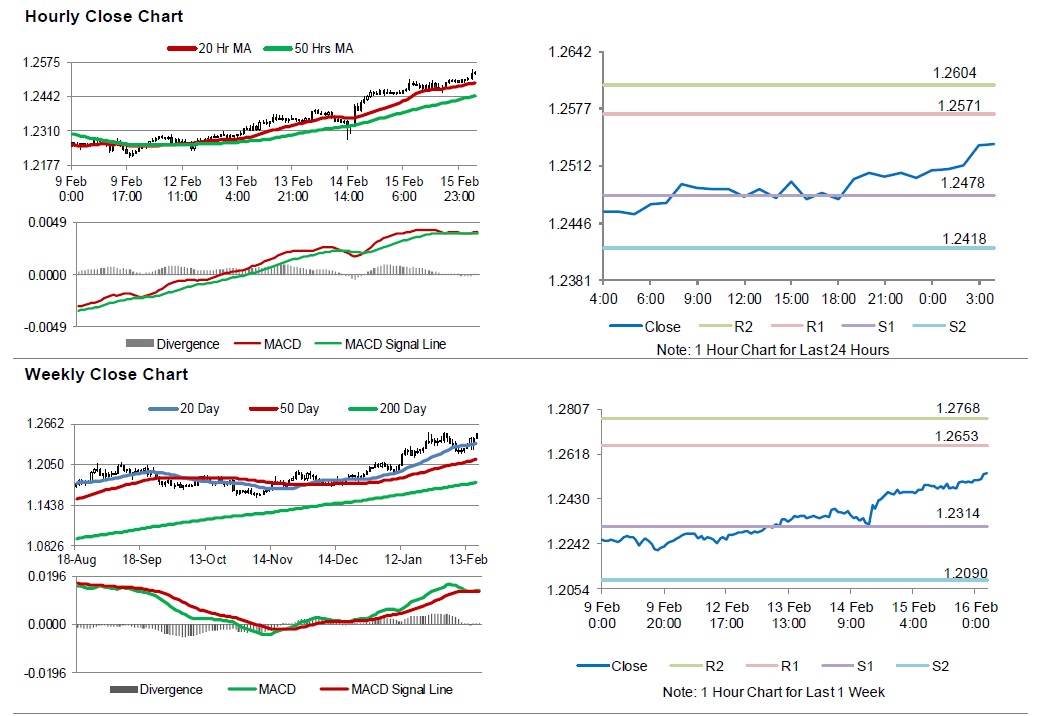

In the Asian session, at GMT0400, the pair is trading at 1.2421, with the EUR trading 0.11% higher against the USD from Friday’s close.

The pair is expected to find support at 1.2358, and a fall through could take it to the next support level of 1.2296. The pair is expected to find its first resistance at 1.2519, and a rise through could take it to the next resistance level of 1.2618.

Going ahead, traders would keep a close watch on Euro-zone’s current account balance and construction output data, both for December, slated to release in few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving average.