For the 24 hours to 23:00 GMT, the EUR rose 0.37% against the USD and closed at 1.1901.

The US Dollar declined against its key counterparts, following downbeat US consumer confidence report.

The CB consumer confidence index dropped to a three-month low level of 122.1 in December, as Americans remained less optimistic about the nation’s economic and future job prospects. The index had registered a revised level of 128.6 in the prior month, while markets were expecting a drop to a level of 128.0.

On the other hand, the nation’s pending home sales unexpectedly advanced 0.2% on a monthly basis in November, compared to a gain of 3.5% in the prior month and defying market consensus for a fall 0.4%.

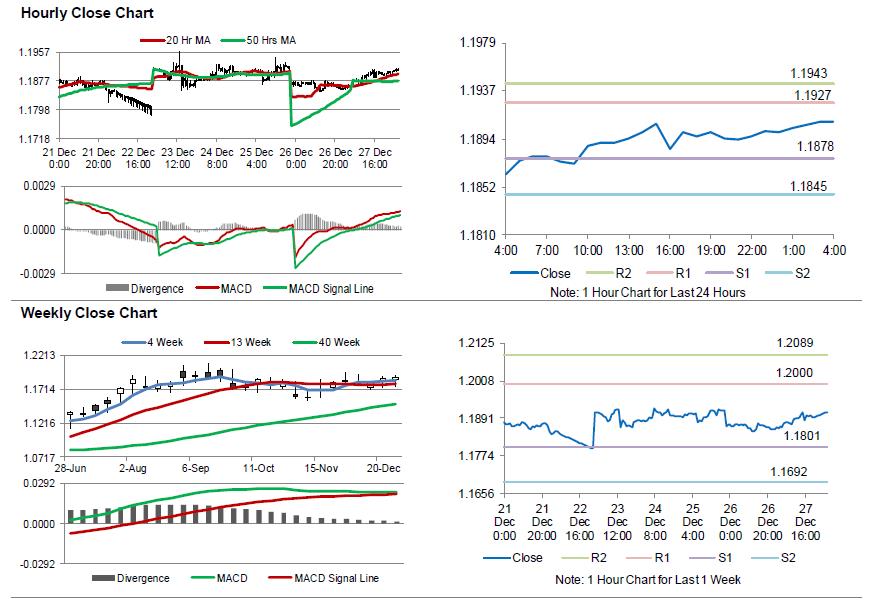

In the Asian session, at GMT0400, the pair is trading at 1.1910, with the EUR trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1878, and a fall through could take it to the next support level of 1.1845. The pair is expected to find its first resistance at 1.1927, and a rise through could take it to the next resistance level of 1.1943.

Going ahead, investors would keep a close watch on the European Central Bank’s (ECB) economic bulletin report, due to release in a few hours. Moreover, the US advance goods trade balance figures for November and initial jobless claims data, scheduled to release later in the day, will be on investors’ radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.