For the 24 hours to 23:00 GMT, the EUR declined 0.28% against the USD and closed at 1.0893, after the release of downbeat economic data in Germany.

Data showed that, Germany’s seasonally adjusted trade balance declined to a level of €20.6 billion in November, following a reading of €22.3 billion in the preceding month. Market anticipated it to decline to a level of €20.2 billion. On the other hand, the nation’s current account rose more than expected to a level of €24.7 billion in November, against market expectations of a fall to a level of €21.0 billion and following previous month’s reading of €22.7 billion. In other economic news, the nation’s seasonally adjusted industrial production unexpectedly fell by 0.3% MoM in November, after increasing 0.5% in the prior month. Investors had expected it to remain steady at 0.5%.

The greenback gained ground, on the back of stronger than expected non-farm payrolls data in the US. Data showed that, US non-farm payrolls surprisingly advanced to a level of 292.0K in December, indicating that health of the nation’s labour market is continuously improving. Markets anticipated it to decline to a level of 200.0K, compared to a reading of 252.0K in the preceding month. Also, unemployment rate remained steady at 5.0% in November, in line with investor expectations.

Other economic data showed that in December, average hourly earnings of all employees remained flat in the US on a monthly basis, lower than market expectations for a rise of 0.2%. In the previous month, average hourly earnings of all employees had climbed 0.2%.

In the Asian session, at GMT0400, the pair is trading at 1.0912, with the EUR trading 0.18% higher from Friday’s close.

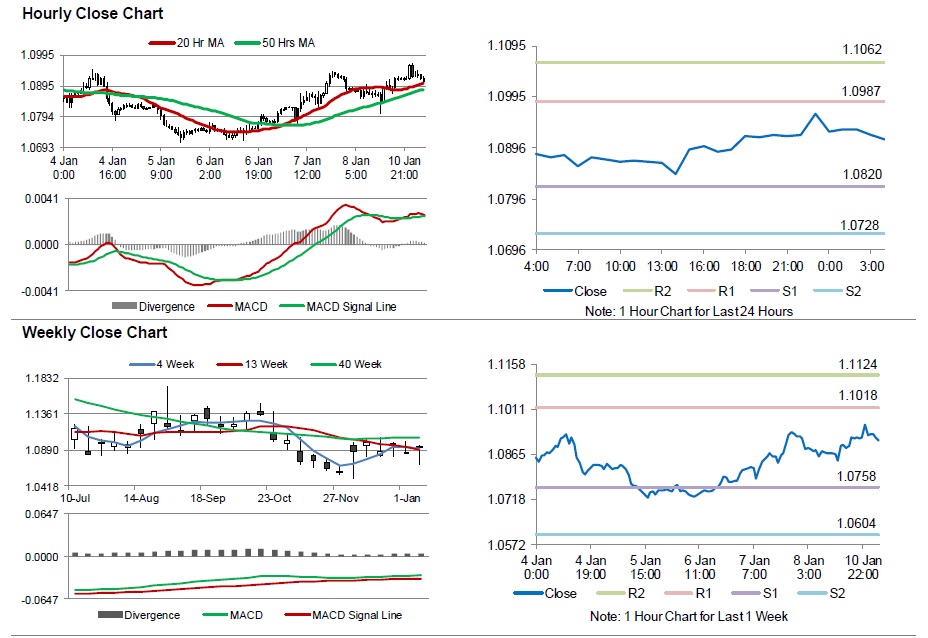

The pair is expected to find support at 1.0820, and a fall through could take it to the next support level of 1.0728. The pair is expected to find its first resistance at 1.0987, and a rise through could take it to the next resistance level of 1.1062.

Going ahead, trading trend in the Euro would be governed by the Euro-zone’s Sentix investor confidence data for January, scheduled in a few hours. Also, investors will look forward to US labour market conditions index for December, scheduled to release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.