For the 24 hours to 23:00 GMT, the EUR declined 0.22% against the USD and closed at 1.0977.

Macroeconomic data indicated that the US consumer price index (CPI) gained by 0.3% MoM in September, meeting market expectations, rising at the fastest pace in five months and adding to hopes for a potential Fed rate hike in December. The CPI had recorded a rise of 0.2% in the prior month. Additionally, on an annual basis, the CPI climbed 1.5% in September, accelerating to the highest level since October 2014 and after recording a gain of 1.1% in the previous month. Meanwhile, the nation’s NAHB housing market index dropped slightly to a level of 63.0 in October, in line with market expectations and following a level of 65.0 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.0992, with the EUR trading 0.14% higher against the USD from yesterday’s close.

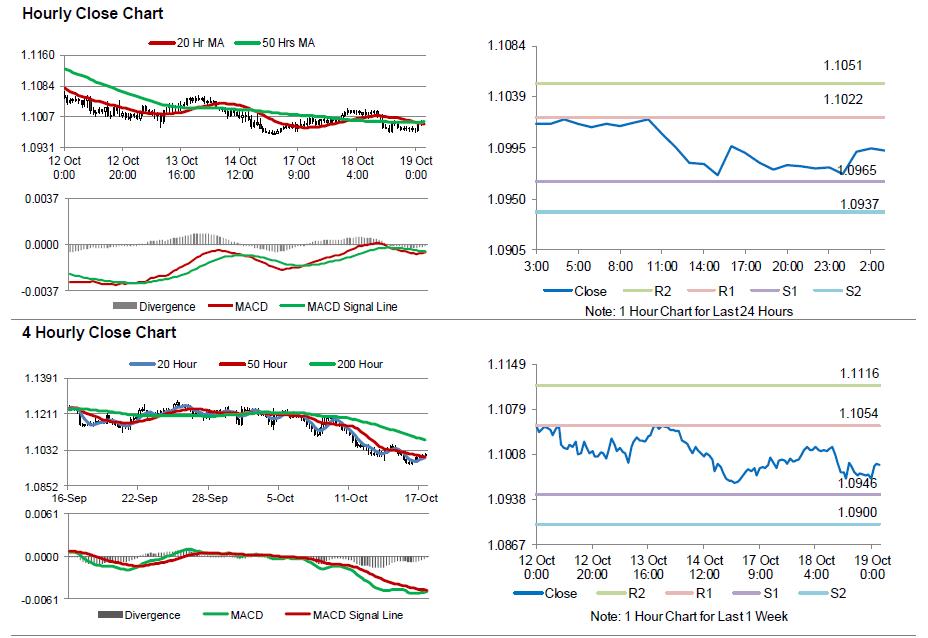

The pair is expected to find support at 1.0965, and a fall through could take it to the next support level of 1.0937. The pair is expected to find its first resistance at 1.1022, and a rise through could take it to the next resistance level of 1.1051.

Going ahead, market participants would look forward to the Euro-zone’s construction output data for August, slated to release in a few hours. Additionally, the US Fed Beige Book report, housing starts and building permits data for September, all due to release later today, would garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.