For the 24 hours to 23:00 GMT, the EUR rose 1.08% against the USD and closed at 1.0691 on Friday, after news emerged that some European Central Bank policymakers raised the possibility of an interest rate hike before the end of its bond purchase programme.

On the data front, Germany’s seasonally adjusted trade surplus surprisingly expanded to a level of €18.5 billion in January, following a revised trade surplus of €18.3 billion in the prior month, while markets expected the nation’s trade surplus to narrow to a level of €18.0 billion. Moreover, the nation’s seasonally adjusted exports rebounded more-than-expected by 2.7% MoM in January, compared to a revised drop of 2.8% in the previous month. Also, the nation’s seasonally adjusted imports climbed higher-than-expected by 3.0% on a monthly basis in January, after recording a revised rise of 0.1% in the prior month.

The greenback lost ground against a basket of major currencies, after the latest US jobs report revealed that wage growth was softer than expected in February, tempering expectations for aggressive interest rate hikes by the Federal Reserve this year.

Data indicated that non-farm payrolls in the US jumped 235.0K in February, surpassing market consensus for an advance of 200.0K, thus painting an improving picture of the nation’s labour market. Non-farm payrolls had recorded a revised increase of 238.0K in the prior month. Moreover, the nation’s unemployment rate eased to 4.7% in February, in line with market expectations and compared to a reading of 4.8% in the previous month. However, the nation’s average hourly earnings of all employees grew less-than-estimated by 0.2% on a monthly basis in February, falling short of market expectations for an advance of 0.3% and compared to a revised similar rise in the previous month. Meanwhile, the nation’s budget deficit narrowed less-than-expected to a level of $192.0 billion in February, compared to a surplus of $51.3 billion in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0697, with the EUR trading 0.06% higher against the USD from Friday’s close.

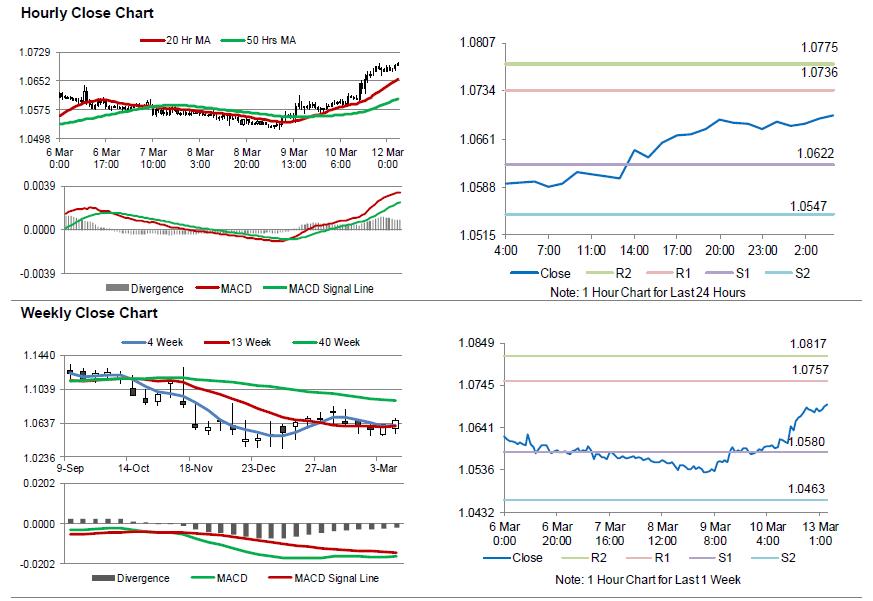

The pair is expected to find support at 1.0622, and a fall through could take it to the next support level of 1.0547. The pair is expected to find its first resistance at 1.0736, and a rise through could take it to the next resistance level of 1.0775.

Moving ahead, investors’ will look forward to a speech by the European Central Bank’s (ECB) President, Mario Draghi along with German Buba monthly report, both due later today. Additionally, the US labour market conditions index for February, slated to release later in the day, will be on investor’s radar.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.