For the 24 hours to 23:00 GMT, the EUR rose 0.62% against the USD and closed at 1.1359.

Macroeconomic data released showed that industrial production in France, the Euro-zone’s second largest economy, rose more-than-expected to 1.6% MoM in August, recording its biggest monthly rise in two years, backed by a strong rise in the nation’s automobile production from a drop of 1.1% in July. . On the other hand, industrial production in Italy fell more-than-expected by 0.5% MoM in August, from a 1.1% growth in the previous month.

In the US, wholesale inventories increased more-than-expected by 0.1% in August, from a 0.3% decline July. In contrast, US wholesale trade sales fell 1.0% MoM in August, compared to a 0.3% decline recorded in the previous month.

Separately, the New York Fed President, William Dudley as well as Dennis Lockhart, President of the Atlanta Fed, stated that an interest rate hike by the US central bank remains likely by the end of 2015. However, they both cautioned that the decision would be taken only after monitoring the future set of economic data.

Elsewhere, , the President of the Chicago Fed, Charles Evans, urged the Fed to remain patient as inflation still remains below its 2.0% target.

In the Asian session, at GMT0300, the pair is trading at 1.1373, with the EUR trading 0.12% higher from Friday’s close.

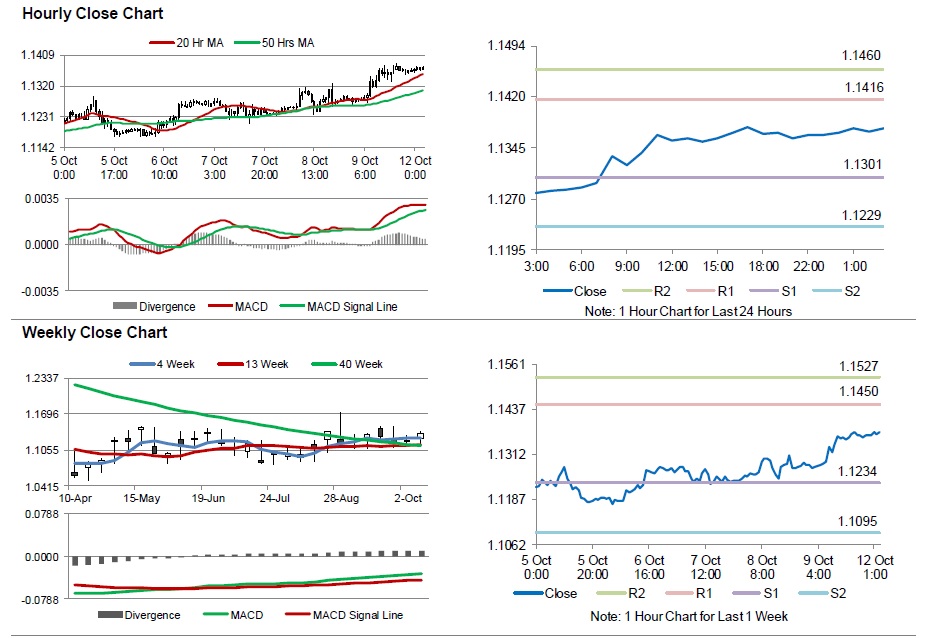

The pair is expected to find support at 1.1301, and a fall through could take it to the next support level of 1.1229. The pair is expected to find its first resistance at 1.1416, and a rise through could take it to the next resistance level of 1.1460.

With no major economic releases in the Euro-zone today, investors would closely monitor Germany’s inflation and ZEW economic sentiment data, scheduled tomorrow to gauge the strength in the nation’s economy.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.