For the 24 hours to 23:00 GMT, the EUR rose 0.18% against the USD and closed at 1.0911.

In economic news, Euro-zone’s final estimate of the consumer price index rose by 0.2% YoY in December, in line with market expectations and following a revised gain of 0.1% in the preceding month. Meanwhile, Euro-zone’s ZEW survey economic sentiment index rose less than expected to a level of 22.7 in January, compared to market expectation for a rise to a level of 27.9 and following a previous month’s reading of 33.9.

Elsewhere, in Germany, the final consumer price inflation dropped 0.1% on a monthly basis in December, in line with market expectations. Moreover, the nation’s ZEW survey economic sentiment index declined to a 3 month low level of 10.2 in January, compared to market expectations of it to fall to a level of 7.9 and following a previous month’s reading of 16.1, thus underlining optimism over the health of the euro zone’s largest economy.

Separately, the IMF trimmed global growth to 3.4% in 2016, compared to its previous forecast of 3.6% and projected a growth of 3.6% in 2017, against an estimation of 3.8%. Also, the IMF cut its growth projections for the US by 0.2 point to 2.6% both in 2016 and 2017.

In the US, the NAHB housing market index remained steady at 60.00 in January, against market expectations to advance to 61.00.

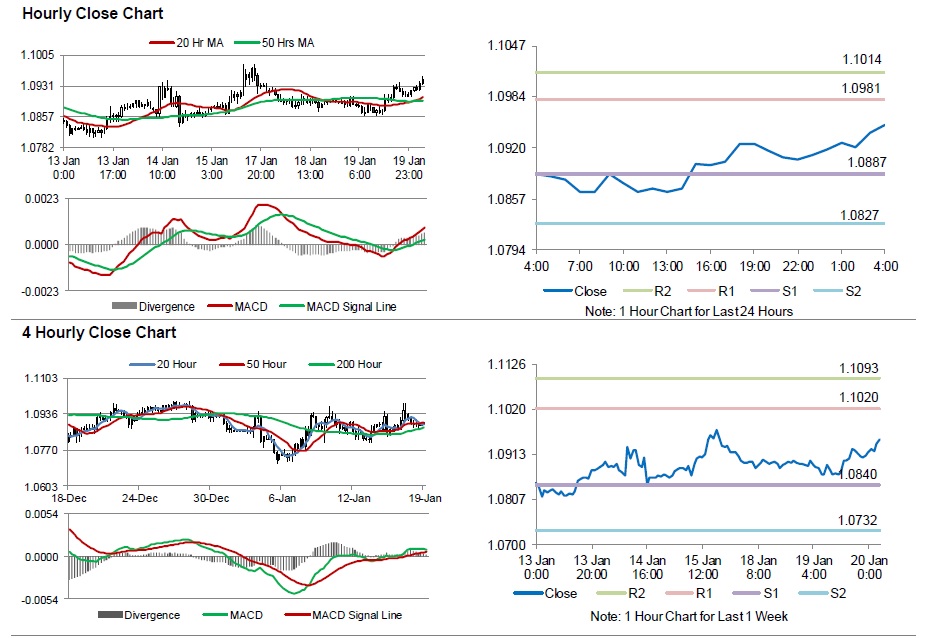

In the Asian session, at GMT0400, the pair is trading at 1.0948, with the EUR trading 0.34% higher from yesterday’s close.

The pair is expected to find support at 1.0887, and a fall through could take it to the next support level of 1.0827. The pair is expected to find its first resistance at 1.0981, and a rise through could take it to the next resistance level of 1.1014.

Going ahead, investors will look forward to Germany’s producer price index, scheduled to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.