For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1282, after industrial production in France and Italy surprisingly declined in December, raising concerns about the Eurozone’s economic growth.

Data showed that industrial output in France, Eurozone’s second largest economy, unexpectedly fell by 1.6% MoM in December, after dropping by 0.9% in the previous month and compared to investor expectations for a 0.2% rise. Additionally, Italy’s seasonally adjusted industrial output unexpectedly fell for the second straight month by 0.7% MoM in December, indicating that the Eurozone’s third-largest economy is affected by global economic slowdown. Meanwhile markets expected for an advance of 0.3%, after recording a drop of 0.5% in the previous month.

In the US, the Federal Reserve Chair, Janet Yellen, highlighted that tightening financial conditions and uncertainty over China’s economic growth posed risks to the US economic outlook, but chances are slim that the Fed would need to reverse the rate tightening cycle. Further, she signalled that the Fed would pursue “gradual” interest rate hikes.

In other economic news, the US MBA mortgage applications rose 9.3% in the week ended 05 February. In the previous week, mortgage applications had dropped 2.6%.

In the Asian session, at GMT0400, the pair is trading at 1.129, with the EUR trading 0.07% higher from yesterday’s close.

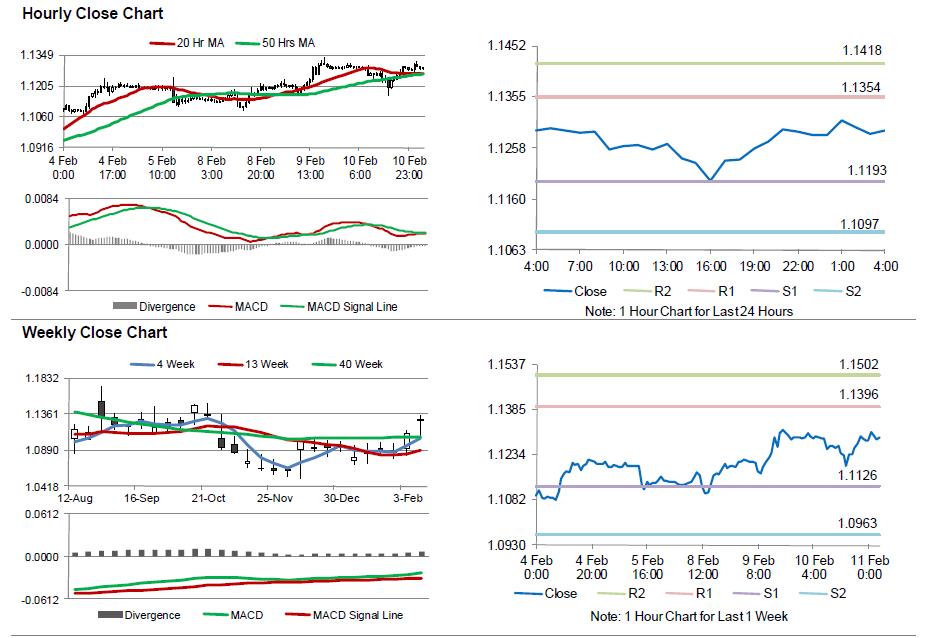

The pair is expected to find support at 1.1193, and a fall through could take it to the next support level of 1.1097. The pair is expected to find its first resistance at 1.1354, and a rise through could take it to the next resistance level of 1.1418.

With no macroeconomic releases in Euro-zone today, investors will look forward to the US initial jobless claims data, slated to release later today.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.