For the 24 hours to 23:00 GMT, the EUR declined 0.35% against the USD and closed at 1.1224 on Friday, after data showed that German trade surplus narrowed to a level of €19.5 billion in July, following a revised trade surplus of €24.7 billion in the previous month. The nation’s seasonally adjusted exports unexpectedly plummeted 2.6% and imports slipped 0.7%, on a monthly basis in July, after registering a revised 0.2% and 1.1% gain, respectively.

The US Dollar gained ground after the Boston Fed President, Eric Rosengren, rooted for gradual interest rate increases in order to avoid overheating of the US economy. He added that failure to do so could shorten, rather than lengthen, the duration of the nation’s recovery. However, he stopped short of discussing exactly when the Fed should move.

In other economic news, US wholesale inventories remained flat in July, after recording a similar reading in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.1237, with the EUR trading 0.12% higher against the USD from Friday’s close.

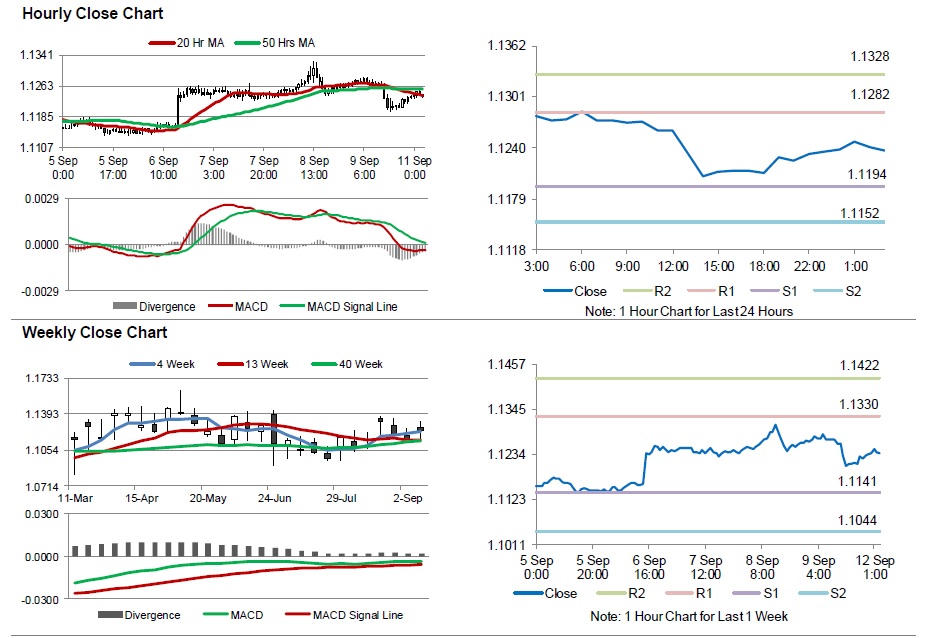

The pair is expected to find support at 1.1194, and a fall through could take it to the next support level of 1.1152. The pair is expected to find its first resistance at 1.1282, and a rise through could take it to the next resistance level of 1.1328.

Moving ahead, market participants will look forward to speeches by the Atlanta Fed President, Dennis Lockhart and the FOMC Member, Lael Brainard, scheduled later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.