For the 24 hours to 23:00 GMT, the EUR rose 0.17% against the USD and closed at 1.3280, following upbeat macroeconomic data from Germany. The Markit manufacturing PMI in the country registered a reading of 52.0 in August, compared to market estimates for a reading of 51.5. The nation’s Markit services PMI came in at 56.4 in August, compared to market expectations of a drop to 55.5.

However, the gains in the common currency were capped by downbeat PMI data from the Eurozone. The manufacturing PMI dropped to a 13-month low at 50.8 in in August, from 51.8, while the services PMI Activity Index fell to a two-month low at 53.5 in August, from 54.2 in July. Meanwhile, the Euro-zone consumer confidence also dropped to -10, a 5-month.

Elsewhere, French manufacturing PMI fell to 15-month low of 46.5 in August, underlying concerns about the economic outlook of the Eurozone’s second largest economy. Meanwhile, the services PMI stood at 51.1, above expectations of a reading of 50.3 in August.

In the US, the Kansas City Fed President Esther George, in an interview from a central bank symposium in Jackson Hole, mentioned that there is steady improvement in the US labour market. During the event, the Philadelphia Fed President, Charles Plosser, warned that the Fed should not wait too long to raise benchmark rates and should start raising it sooner, while pursuing a gradual approach. Also, the San Francisco Fed President, John Williams told in an interview that he expects the central bank to raise interest rates in the summer of 2015. In economic data from the US, the number of people filing for unemployment assistance for the week ended August 9 declined to 298K, from a revised 312K in the preceding week, fuelling optimism over the strength of the labour market. The growth outlook was further bolstered after the US manufacturing PMI recorded a level of 58.0 in August, the highest since March 2011. Additionally, existing home sales increased 2.4% (M-o-M) to an annual rate of 5.15 million units, recording the highest reading since last September. In other data, the Philadelphia Fed manufacturing survey came in at 28.0 in August, while the CB leading indicator in the US rose 0.9% in July.

In the Asian session, at GMT0300, the pair is trading at 1.3281, with the EUR trading tad higher from yesterday’s close.

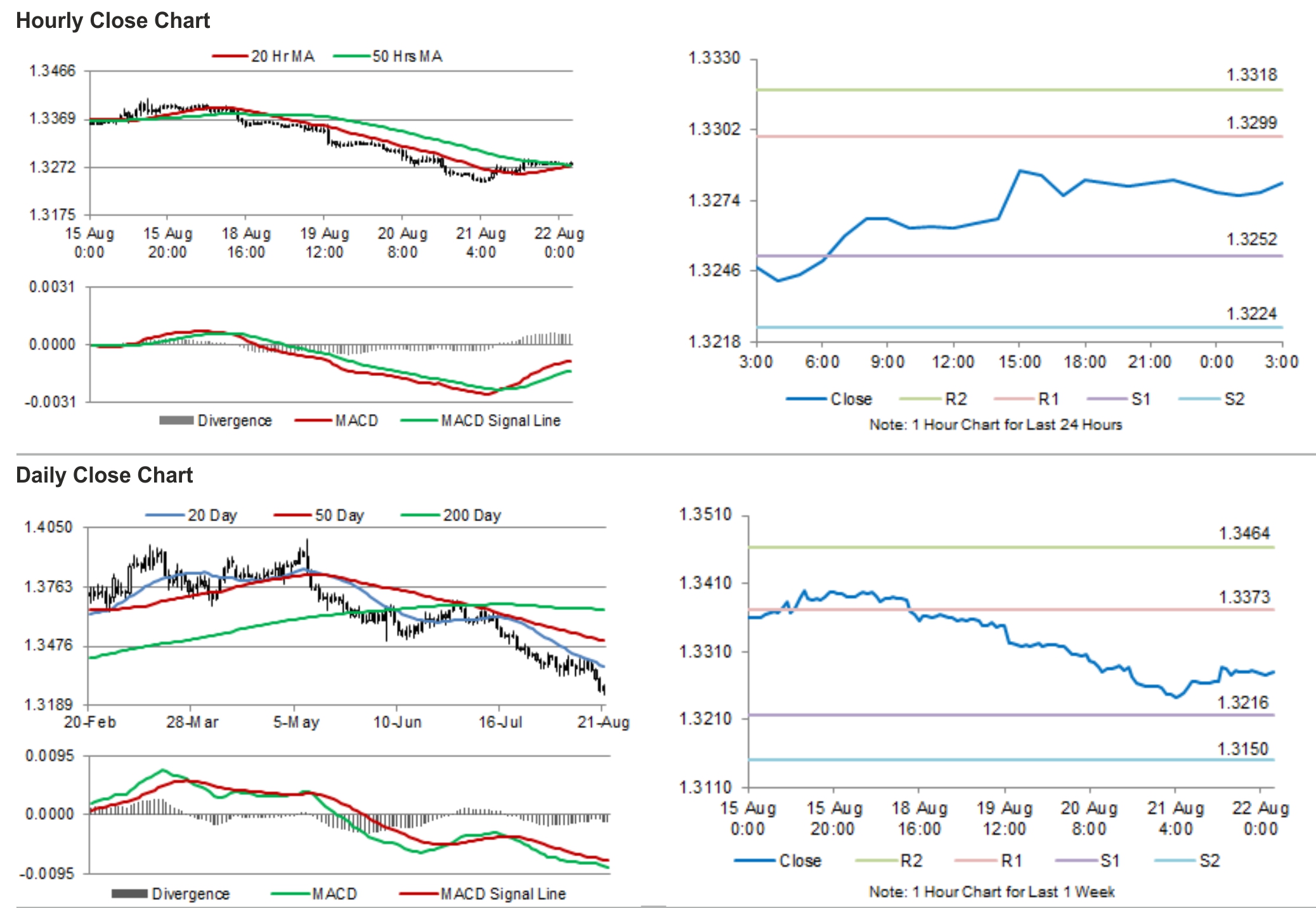

The pair is expected to find support at 1.3252, and a fall through could take it to the next support level of 1.3224. The pair is expected to find its first resistance at 1.3299, and a rise through could take it to the next resistance level of 1.3318.

Trading trends in the pair today would be mainly determined by the speeches of heads of the Fed and the ECB, in Jackson Hole, scheduled later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.