For the 24 hours to 23:00 GMT, the EUR declined 0.90% against the USD and closed at 1.0866.

Macroeconomic data showed that Euro-zone’s final Markit services PMI advanced to a level of 54.1 in October, from a reading of 53.7 in the previous month. The preliminary figures had recorded a rise to a level of 54.2. Also, in Germany, Euro-zone’s largest economy, the final Markit services PMI index rose to a level of 54.5 in the same month, compared to market expectations of an advance to a level of 55.2, and from a reading of 54.1 in the previous month.

The greenback gained ground after the Federal Reserve Chairperson, Janet Yellen, announced that the central bank will go ahead with an interest rate hike at its December meeting, if the economy supports such a move. Elsewhere, the New York Fed President, William Dudley, mirrored the Fed Chair’s remarks and stated that interest rate hike is a “live possibility”.

In economic news, the US private sector employment rose more-than-expected to a level of 182.0K in October, from a revised gain of 190.0K in the previous month. Investors had expected it to advance to a level of 180.0K. Further, the US trade deficit narrowed more-than-anticipated to a level of $40.8 billion in September, from an upwardly revised trade deficit of $48.0 billion in the previous month.

In other economic news, the US ISM non-manufacturing PMI index rose unexpectedly to a level of 59.1 in October, compared to a reading of 56.9 in the previous month. Investors had expected it to fall to a level of 56.5. On the other hand, the final print of the US Markit services PMI index registered a drop to a level of 54.8 in October, from a reading of 55.1 in the previous month. Also, the nation’s MBA mortgage applications declined for the second consecutive week by 0.8% in the week ended 30 October, compared to a drop of 3.5% in the previous week.

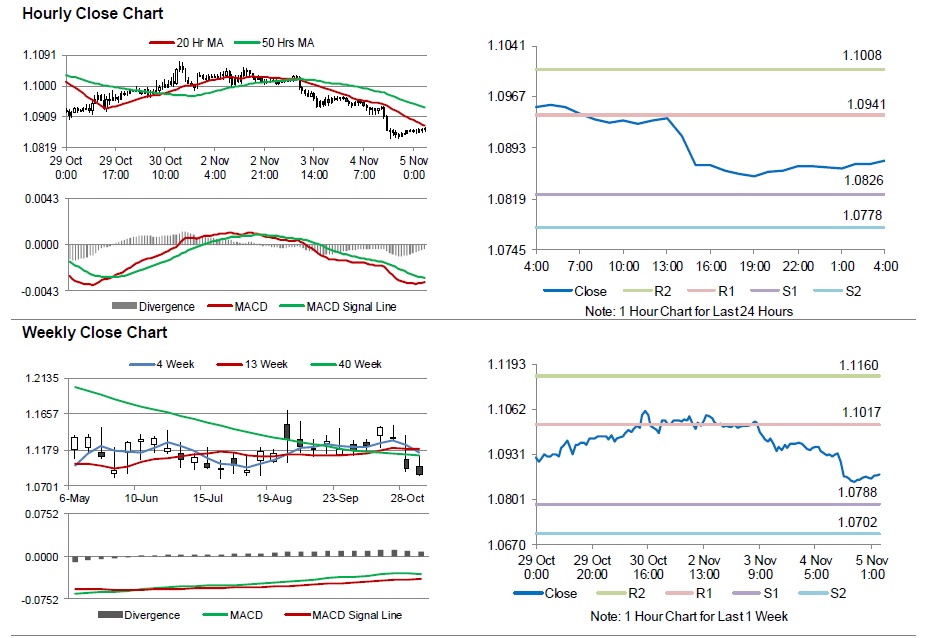

In the Asian session, at GMT0400, the pair is trading at 1.0875, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.0826, and a fall through could take it to the next support level of 1.0778. The pair is expected to find its first resistance at 1.0941, and a rise through could take it to the next resistance level of 1.1008.

Going ahead, market participants will look forward to the release of ECB’s economic growth forecasts, in a few hours. In addition to this, the US initial jobless claims data, scheduled to be released later in the day, will also garner investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.