For the 24 hours to 23:00 GMT, EUR rose 0.13% against the USD and closed at 1.3534.

The US Dollar declined against the Euro after the ADP report showed that the US private sector added 175,000 jobs in January, less than analysts’ expectations for an addition of 195,000 jobs and compared to a revised gain of 227,000 employees recorded in the previous month. However, the losses in the greenback were kept in check after the ISM reported a more-than-expected rise in its January PMI for the US service sector and after two of the top Fed officials expressed an optimistic view on the central bank’s tapering plans.

The Philadelphia Fed President, Charles Plosser, indicated that he expects the US economy to witness a 3% growth in 2014, urging the Fed to speed up the tapering process of its bond-purchase program in order to reflect the strengthening economy. Meanwhile, the Atlanta Fed President, Dennis Lockhart, highlighted the improving economic fundamentals of the US economy and hinted the possibility for the Fed’s QE tapering to continue at current pace and eventually to end in 2014.

Separately, the ratings agency, Moody’s Investors Service indicated that an increase in the US borrowing ceiling this week would not pose a risk to the nation’s “AAA” credit rating, however Fitch Ratings dissented to Moody’s view, and stated that the timeliness of government actions would determine how it would resolve a negative outlook on the nation’s top “AAA” rating.

Meanwhile, in the Euro-zone, Markit Economics reported that its service PMI for the region rose less than markets’ expectations to a reading of 51.6 in January, from a previous month’s level of 51.0. Similarly, its composite PMI also failed to meet market expectations by registering a rise to a level of 52.9 in January, from a reading of 52.1 recorded in the preceding month. Another report, showed that Germany’s service PMI unexpectedly declined to a reading of 53.1 in January, from a figure of 53.5 seen in December. Separately, the Eurostat revealed that retail sales in the region declined 1.6% (MoM) in December, more than analysts’ call for a fall of 0.5% and compared to a 0.9% (MoM) rise witnessed in the previous month.

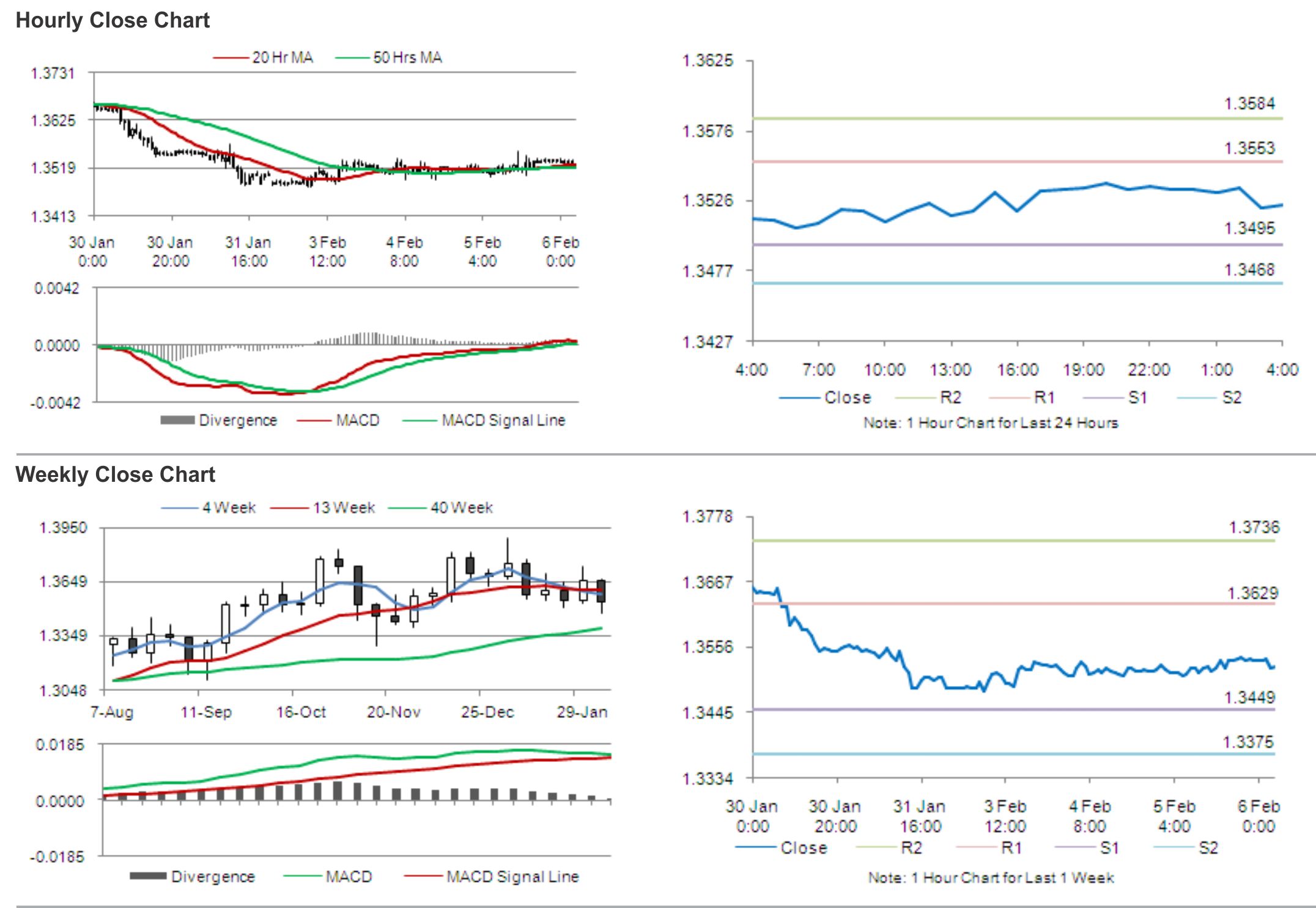

In the Asian session, at GMT0400, the pair is trading at 1.3523, with the EUR trading 0.08% lower from yesterday’s close.

The pair is expected to find support at 1.3495, and a fall through could take it to the next support level of 1.3468. The pair is expected to find its first resistance at 1.3553, and a rise through could take it to the next resistance level of 1.3584.

Traders keenly await the European Central Bank (ECB)’s interest rate decision due later today for further cues in the Euro. Also later today, the Bundesbank is expected to publish a report on the retail sales of Germany for the month of December.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.