For the 24 hours to 23:00 GMT, the EUR rose 0.08% against the USD and closed at 1.1266.

The US dollar declined against the euro, amid concerns over US-EU trade tensions, after President Donald Trump stated that he would impose tariffs on EU products.

In the US, data showed that the US NFIB small business optimism index climbed to a level of 101.8 in March, compared to a level of 101.7 in the previous month. Meanwhile, the nation’s JOLTs job openings declined to a 11-month low level of 7087.0K in February, compared to a revised level of 7625.0K in the prior month. Markets had expected JOLTs job openings to drop to a level of 7550.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1259, with the EUR trading 0.06% lower against the USD from yesterday’s close.

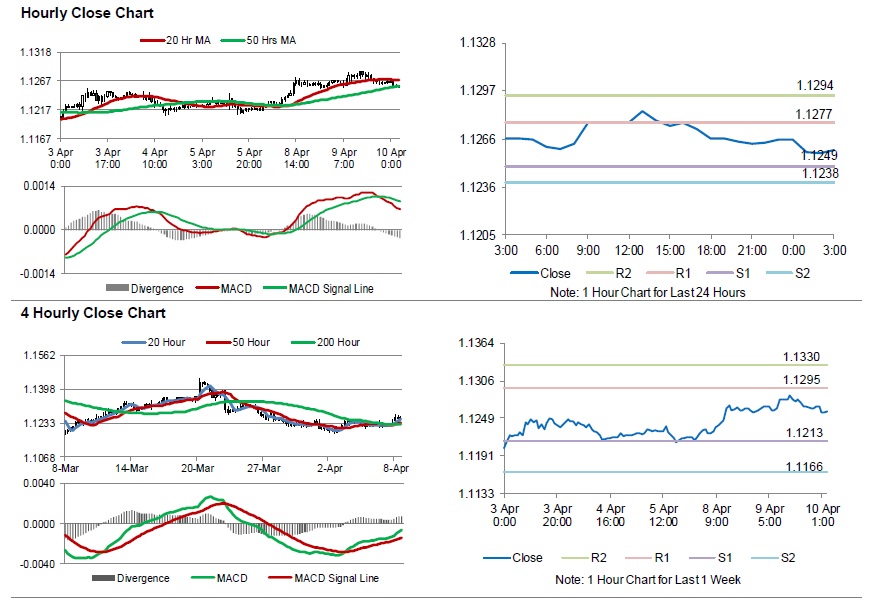

The pair is expected to find support at 1.1249, and a fall through could take it to the next support level of 1.1238. The pair is expected to find its first resistance at 1.1277, and a rise through could take it to the next resistance level of 1.1294.

Moving ahead, traders would await the European Central Bank’s (ECB) interest rate decision, set to release later in the day. Later in the day, the US consumer price index and average weekly earnings, both for March along with the MBA mortgage applications will keep traders on their toes. Also, the Federal Reserve’s March meeting minutes, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.