For the 24 hours to 23:00 GMT, EUR rose 0.15% against the USD and closed at 1.3766, amid passive trading with most investors limiting their trades on account of a holiday.

On Tuesday, consumer confidence in the US improved to the three month high level of 78.1 in December, higher than market expectation of a level of 76.3 and compared to a revised reading of 72.0 reported in November, on the back positive macroeconomic and political developments in the US. Also, the Standard & Poor’s/Case-Shiller 20-city home price gauge, increased 13.61% on an annual basis in October, faster as compared to a revised rise of 13.25% recorded in September. Meanwhile, manufacturing activity index in Chicago deteriorated to a reading of 59.1 in December, from a level of 63.0 recorded in the previous month. Markets had expected the index to fall to a reading of 61.0 in December.

In a note worthy development, Latvia became a part of the Euro-area as the eighteenth member of the Euro-zone.

In the Asian session, at GMT0400, the pair is trading at 1.3746, with the EUR trading 0.15% lower from yesterday’s close.

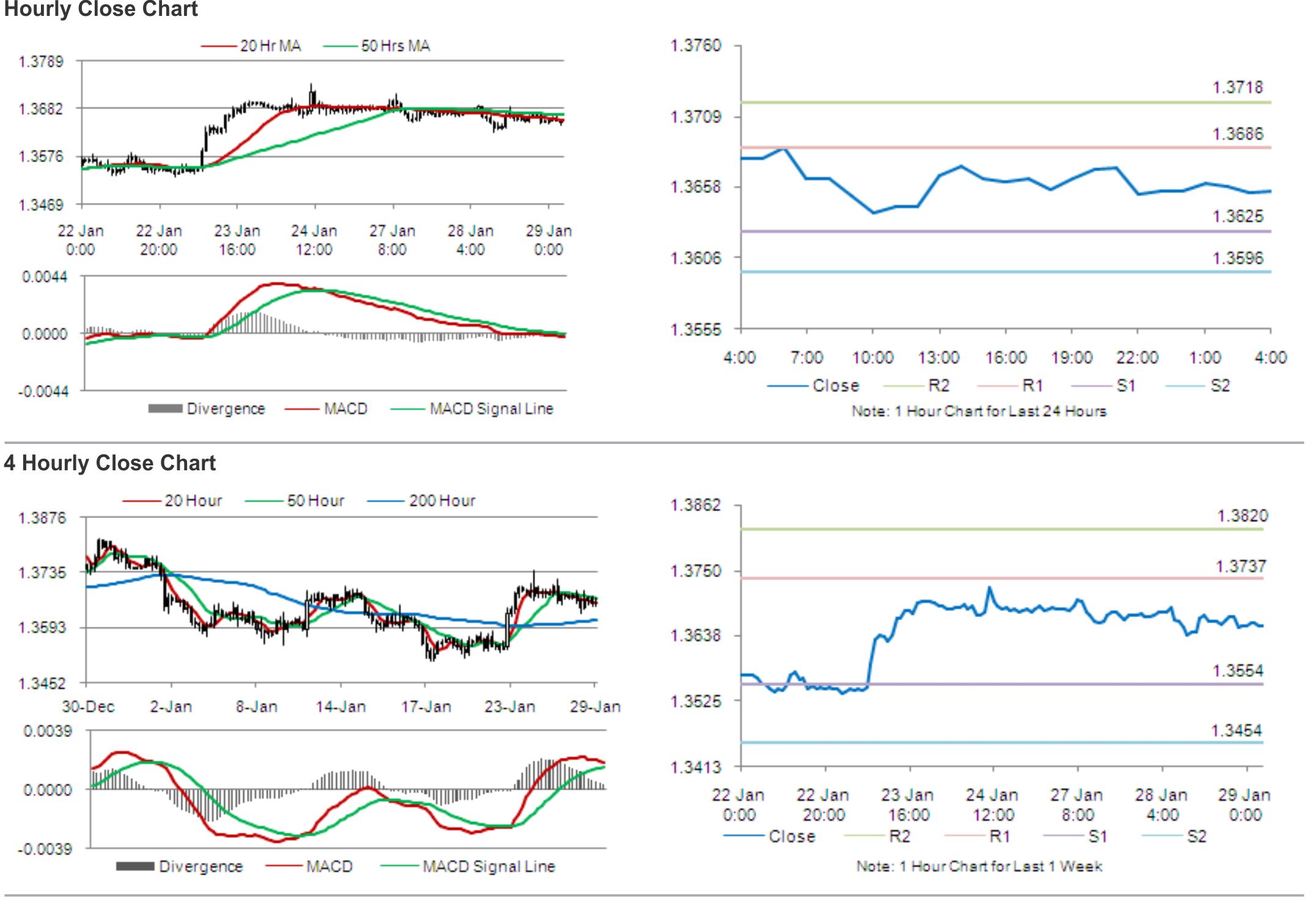

The pair is expected to find support at 1.3732, and a fall through could take it to the next support level of 1.3719. The pair is expected to find its first resistance at 1.3768, and a rise through could take it to the next resistance level of 1.3791.

Ahead today, market participants are expected to keep a close tab on the release of manufacturing gauges across the Euro-zone, to evaluate the health of the manufacturing sector in the bloc.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.