For the 24 hours to 23:00 GMT, the EUR rose 0.38% against the USD and closed at 1.0940.

Gains in the common-currency were kept in check, after Germany’s flash consumer price index fell 0.8% MoM in January, at par with market expectations and following a drop of 0.1% in the preceding month, thus pointing towards further stimulus from the ECB.

Other economic data showed that the Euro-zone’s final consumer confidence index remained steady at -6.3 in January, in line with market expectations. Additionally, Euro-zone’s economic sentiment indicator edged down to 105.0 in January, touching its lowest reading since August, from a revised reading of 106.7 in the previous month while markets expected it to fall to a level of 106.4. Moreover, the industrial confidence index declined more than anticipated to a level of -3.2 in January, compared to market expectations of a fall to -2.5 and after recording a level of 2.0 in the preceding month.

In the US, initial jobless claims fell more than expected to a level of 278K in the week ended 23 January, indicating that the nation’s labour market growth is still on track despite a slower economy. Meanwhile, markets expected for a fall to a level of 281K, following a revised decline of 294K in the previous week.

On the other hand, the nation’s preliminary durable goods orders declined more than anticipated by 5.1% in December while markets expected it to fall 0.7% and after recording a revised drop of 0.5% in the preceding month. Meanwhile, the nation’s pending home sales index rebounded less than expected by 0.1% MoM in December, compared to an anticipated gain of 0.9%and following a revised fall of 1.1% in the preceding month.

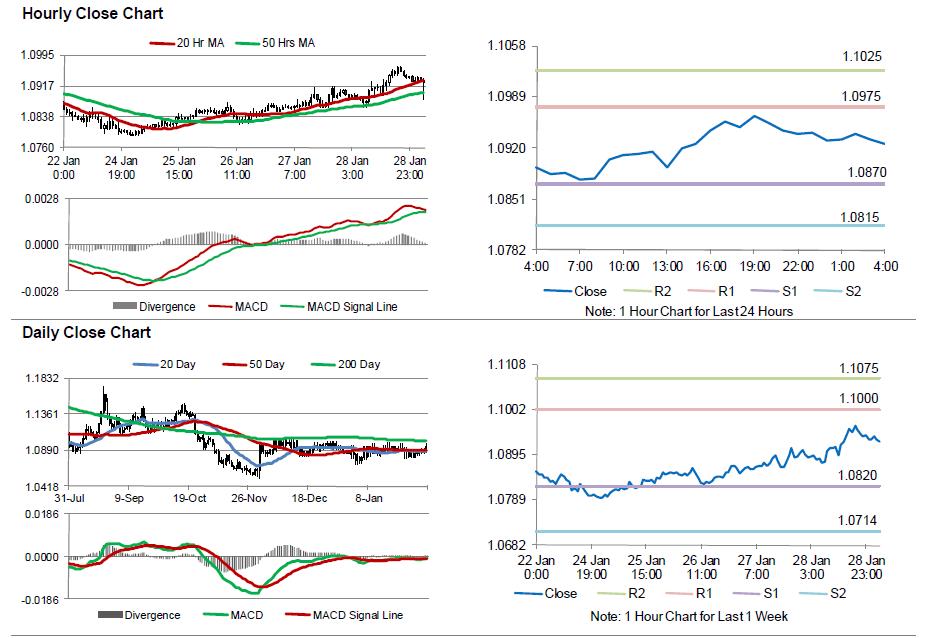

In the Asian session, at GMT0400, the pair is trading at 1.0926, with the EUR trading 0.13% lower from yesterday’s close.

The pair is expected to find support at 1.0870, and a fall through could take it to the next support level of 1.0815. The pair is expected to find its first resistance at 1.0975, and a rise through could take it to the next resistance level of 1.1025.

Going ahead, market participants will keep a close watch on Euro-zone’s flash annual consumer price index and Germany’s retail sales data, schedule to release in a few hours. Additionally, US GDP, advance goods trade balance and Michigan confidence index data will garner lot of market attention, due to release later today.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.