For the 24 hours to 23:00 GMT, the EUR declined 0.57% against the USD and closed at 1.1170, after hints of further easing of monetary policy by the ECB President.

Yesterday, the ECB President, Mario Draghi, stated that the central bank won’t hesitate to ease monetary policy further in the next month, highlighting risks from volatile financial markets, a slowdown in global growth and low oil prices. He further added that the central bank is ready to do its part to boost the region’s growth as well as inflation and would keep a close watch on the impact of plunging oil prices and turmoil in financial markets on the economy.

In other economic news, Euro-zone’s seasonally adjusted trade surplus narrowed more-than-expected to €21.0 billion in December, while markets expected it to fall to €22.0 billion and following a revised surplus of €22.6 billion in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.1152, with the EUR trading 0.16% lower from yesterday’s close.

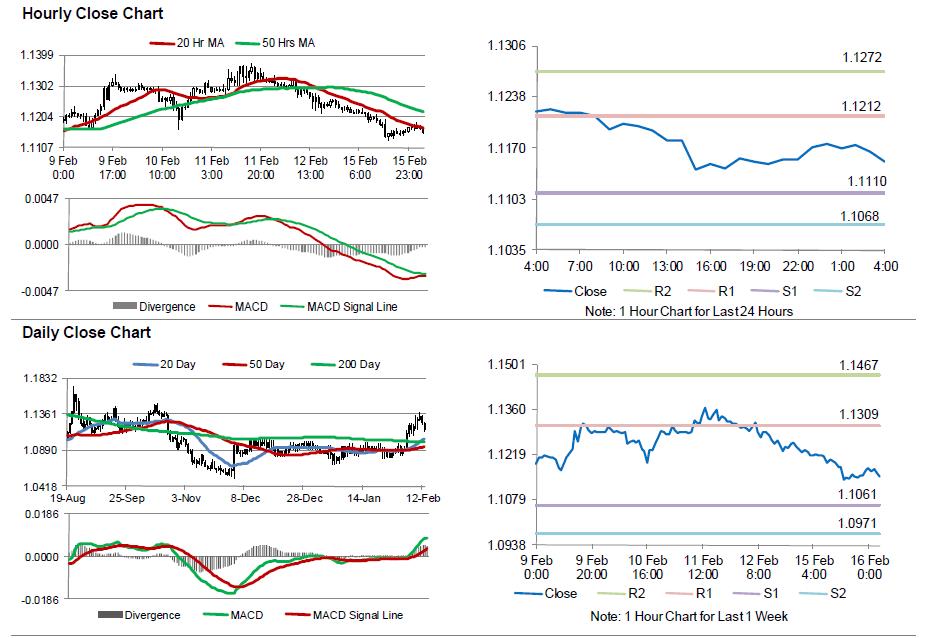

The pair is expected to find support at 1.1110, and a fall through could take it to the next support level of 1.1068. The pair is expected to find its first resistance at 1.1212, and a rise through could take it to the next resistance level of 1.1272.

Looking ahead, investors await the release of Euro-zone’s ZEW economic sentiment survey data for February, scheduled to be released in a few hours. Additionally, the US NAHB housing market index data for February, due later today, would also grab market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.