For the 24 hours to 23:00 GMT, the EUR declined 0.80% against the USD and closed at 1.0646, following dovish comments by the ECB President, Mario Draghi.

The ECB Chief reiterated that the central bank will not hesitate to unleash further stimulus measures and would take all the necessary steps in order ensure that inflation in the Eurozone returns rapidly towards its goal of just under 2%.

In other economic news, Eurozone’s preliminary consumer confidence index rose more-than-expected to a reading of -6.0 in November, compared to market expectations of a rise to a level of -7.5, and after recording a reading of -7.6 in the previous month.

In the US, the Kansas City Fed manufacturing activity index rose to a level of 1.0 in November, compared to market expectations of a rise to 0.0. In the previous month, it had registered a reading of -1.0.

Separately, two top officials of the US Federal Reserve, namely, St. Louis Fed President, James Bullard and New York Fed President, William Dudley indicated that the probability of a hike in interest rates have increased but also stressed that any decision by the central bank will be data dependent.

In the Asian session, at GMT0400, the pair is trading at 1.0615, with the EUR trading 0.3% lower from Friday’s close.

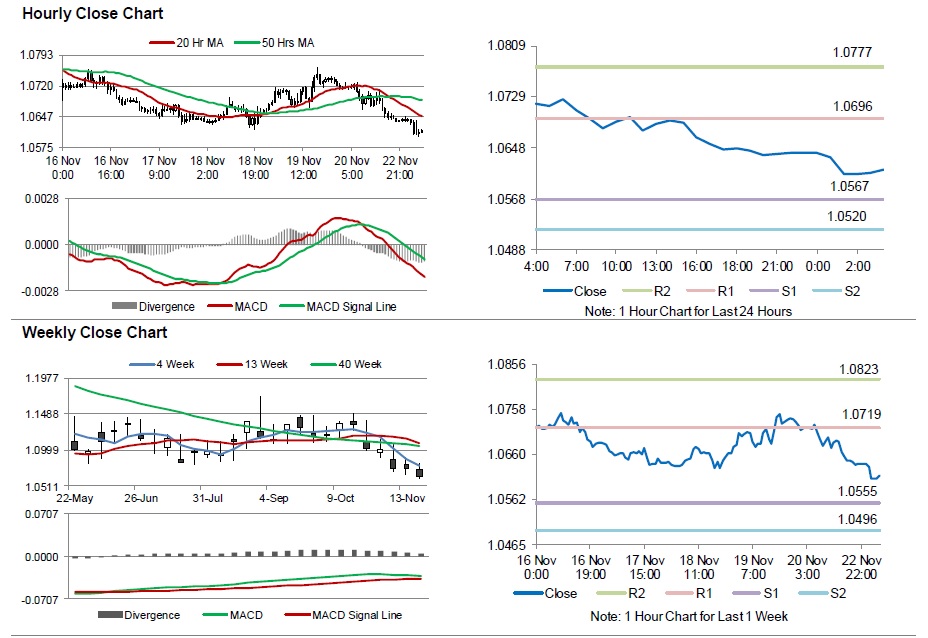

The pair is expected to find support at 1.0567, and a fall through could take it to the next support level of 1.0520. The pair is expected to find its first resistance at 1.0696, and a rise through could take it to the next resistance level of 1.0777.

Going ahead, market participants will concentrate on preliminary Markit manufacturing and services PMI data for November across the Euro-zone, scheduled to be released in a few hours. Additionally, investors will also look forward to the US Chicago Fed national activity index, flash Markit manufacturing PMI and existing home sales data, scheduled to be released later today.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.